While President Donald Trump’s pricing war aims to trigger a boom from manufacturing at home, American companies are firmly focused on “bits” rather than “bricks and mortar”.

This contrast is obvious in the spending models of the magnificent 7 (Mag 7) Stocks – A group comprising technological companies with large capitalization, including the alphabet (Google parent company)Amazon, Apple, meta-platforms (Facebook and Instagram parent company)Microsoft, Nvidia and Tesla.

These companies should spend cumulatively $ 650 billion this year for capital expenses (CAPEX) and research and development (R&D)According to data followed by Lloyds Bank. This amount is greater than what the British government spends in public investment in one year, the bank noted in a note on Thursday.

If this number alone does not impress yourself, consider this: the total investment expenditure on the scale of the economy on equipment and computer software continued to increase this year, representing 6.1% of GDP, while the private non -residential and fixed investment, excluding it, has shrunk consecutive quarters.

Fomo and AI

According to the Stratege of Lloyds FX Nicholas Kennedy, the drop in investments in other sectors of the economy could be due to several reasons, in particular the fear of missing (Fomo) On artificial intelligence (AI) boom.

“There may be explanations other than a spreading by IT expenses and political / commercial uncertainties on which you could appeal; the construction boom which was triggered by Biden’s Chips Act, which stimulated the structures, disappeared, for example.

The graph indicates that American corporate expenses on equipment and computer software increased to 1.45 billion of dollars, which represents an increase of 13.6% from one year to the next. The countdown represents more than 40% of the total of American private fixed investments.

The GDP estimate in the American second quarter, published by the Bureau of Economic Analysis at the start of this week, showed that private fixed investment in computer science had increased by 12.4% quarter on site.

Meanwhile, investing in non -IT sectors or the wider economy dropped by 4.9%, extending the three -quarter drop.

“Bits” “bricks”

This continuous domination of “bits” expenditure in American companies should calm the nerves of those who fear that the emphasis put by the administration on manufacturing can aspire the capital far from the technological markets, including emerging avenues such as cryptocurrencies.

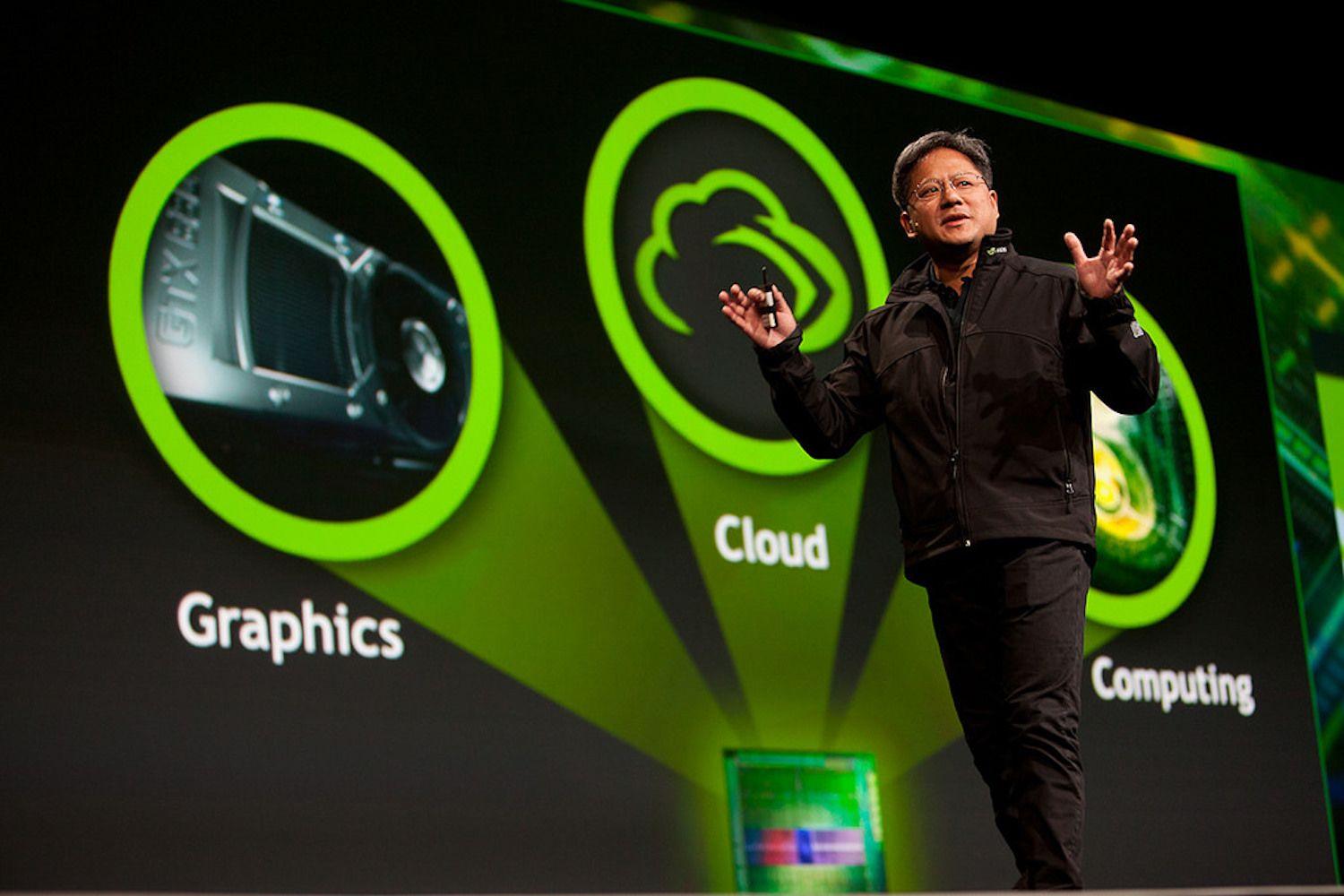

Bitcoin and NVDA, the Bellwether for everything related to AI, both heard at the end of November 2022 with the launch of Chatgpt and have since appreciated incredible bull races, demonstrating a powerful correlation between the rise of technology and the cryptographic market.

“Whether it is [AI spending boom] Generates a return is another matter, but he resumes plans to bits of the bricks, “said Kennedy.

In addition, the cryptography market has also found a significant rear wind in the form of a favorable regulatory policy in Trump. The administration has demonstrated its pro-Crypto bias thanks to the signing of several key law elements aimed at clarifying the regulatory monitoring of digital assets and stablecoins, including measures that have collected bipartite support. In addition, the administration has made strategic appointments to financial regulation organizations.