The governance token of decentralized finance lender Aave emerged as one of the strongest performers throughout the weekend as crypto assets rebounded from Friday’s lows.

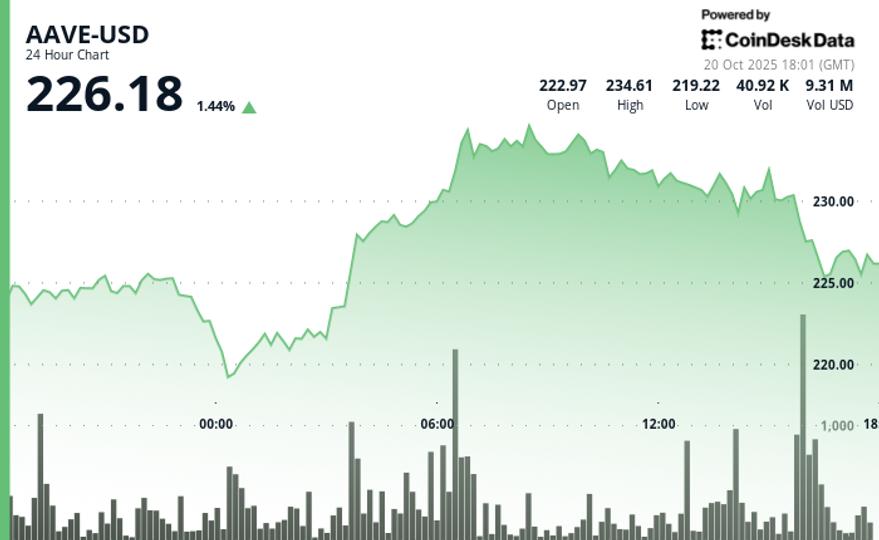

The token rose more than 10% on Monday to briefly surpass $230, just behind the Oracle network’s native token Chainlink. among members of the CoinDesk 20 Index.

AAVE pared gains amid short-term profit-taking that emerged later in Monday’s session, consolidating above $225, CoinDesk Research’s analysis model noted.

In addition to price action, Aave is gaining momentum in the rapidly growing token asset lending market. Grove, an on-chain capital allocator closely linked to Sky (SKY), has outlined plans to provide and the Circle stablecoins to Horizon, Aave’s new institutional lending marketplace where qualified borrowers post real-world tokenized assets as collateral for loans.

The integration, pending governance approval, could increase liquidity for institutions that borrow against assets such as US Treasury tokens. Horizon already supports collateral from issuers like Superstate and Centrifuge, with Chainlink providing valuation data and third-party risk assessments from Llama Risk and Chaos Labs.

If approved, Grove’s contribution could help turn token assets into real working capital.

Technical indicators:

- Bullish momentum holds despite the pullback from highs, as the token maintains the uptrend above key support.

- Several failed attempts above $231.00 highlight persistent overhead resistance.

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team to ensure accuracy and compliance. our standards. For more information, see CoinDesk Comprehensive AI Policy.