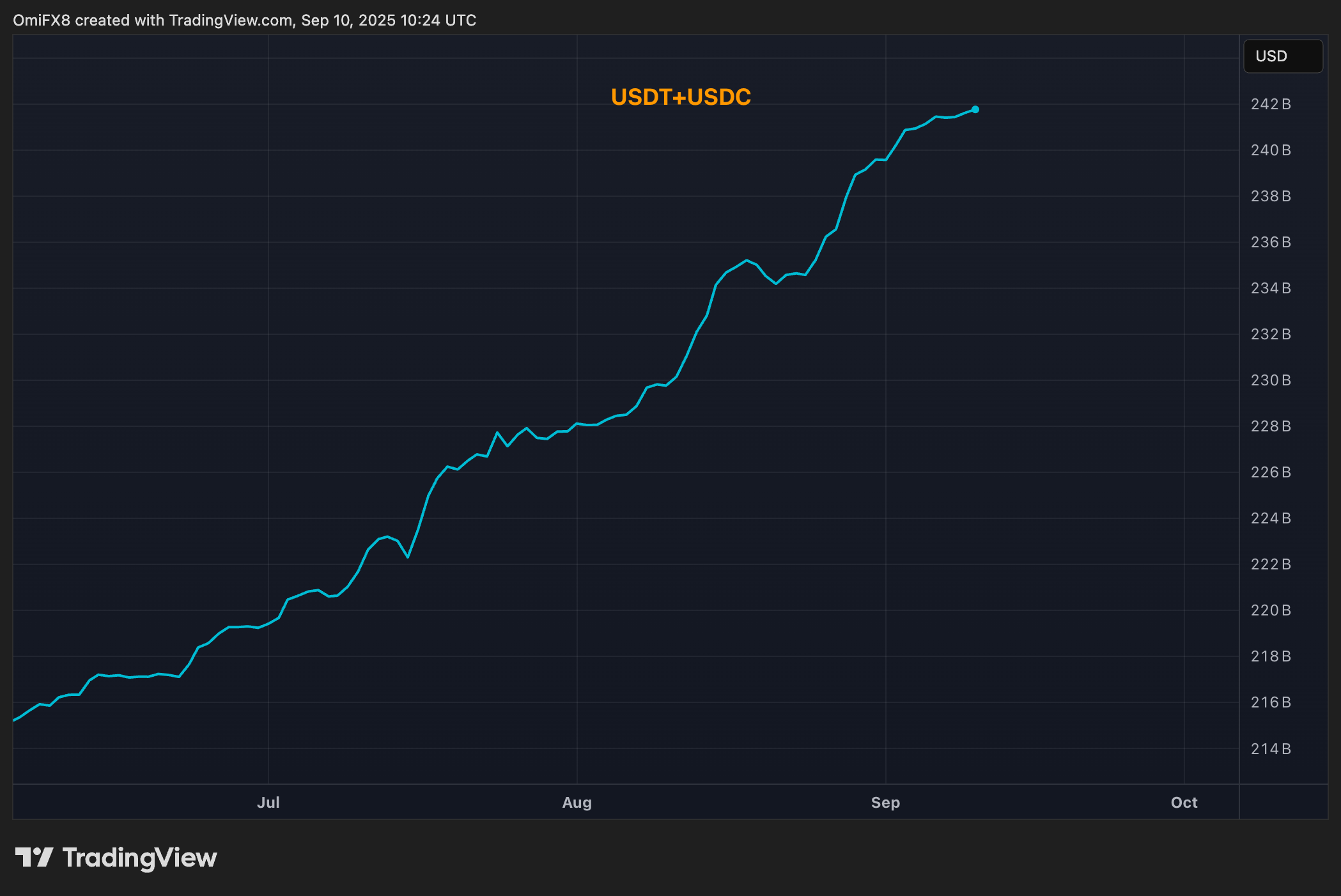

The stablecoin sector of $ 270 billion has increased significantly but still represents less than 8% of the total crypto market capitalization, a level he has held since 2020, according to a JPMorgan research note.

This dynamic could transform the upcoming wave of the stable United States into a zero-sum competition, unless the cryptography market itself is developing significantly, analysts led by Nikolaos Panigirtzoglou have written.

TETHER, whose USDT is mainly used abroad, plans to start a token in accordance with the United States, USAT. Unlike the USDT, whose reserves are around 80% in accordance with American requirements, the USAT support would fully meet new regulatory standards, the bank said.

Stablecoins are cryptocurrencies whose value is linked to another asset, such as US dollar or gold. They play a major role in the cryptocurrency markets, providing payment infrastructure, and are also used to transfer money internationally. Tether’s USDT is the largest stablecoin, followed by Circle’s (CRCL) USDC.

The adoption of American legislation on the stables in July has already stimulated a new series of launches intended for the USDC in Circle, which dominates the American market, noted the report.

While new players realize the position before regulatory implementation, the growth of the Stablescoin market remains linked to the overall Crypto market capitalization, analysts wrote.

Circle also loses ground to competitors as hyperliquidal, the exchange of which alone represents almost 7.5% of the use of the USDC, as well as the Giants Fintech Paypal (PYPL)Robinhood (HOOD)And Revolut, who deploys their own tokens, said JPMorgan.

In response, Circle develops ARC, a blockchain adapted to USDC transactions, to improve speed, safety and interoperability and maintain Central USDC with cryptographic infrastructure.

Without a significant expansion, the new wave of competition from Stablecoin can simply redistribute the market share rather than developing the pie, added the report.

The USDC offer increased to $ 72.5 billion, 25% in front of Wall Street’s company estimates, Bernstein, the broker said in a report earlier this month.

Find out more: USDC market share of Circle “on a tear”, explains the Wall Street Bernstein broker