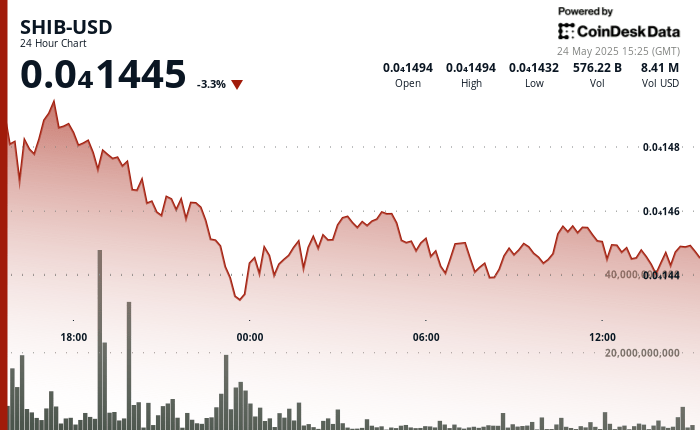

Shiba Inu (SCH) stabilized after significant price volatility, establishing a consolidation model between $ 0.00001440 and $ 0.00001456.

The same token was faced with intense sales pressure with a volume reaching 1.72 Billion during the peak drop, but several support tests at $ 0.00001440 showed a strong interest from the buyer.

Despite short -term fluctuations, blockchain data reveal a remarkable holders of holders, with more than 1.13 million addresses retaining their positions for more than a year, signaling confidence in the long -term SHIB perspectives.

The Shiba Inu ecosystem continues to develop with an important update of the Shibarium blockchain focused on improving decentralization. This is aligned with the team’s strategy to improve the usefulness beyond the status of the same.

While the technical indicators have mixed signals with a moderate bullish impulse but lacking in a strong evasion confirmation, the IA forecasts from platforms such as Google Gemini suggest potential growth at $ 0.00003 by 2025, which represents a possible increase of 105.9% compared to the current levels.

Strengths of technical analysis

- SHIB experienced a significant price drop of 5.4% over the period 24 hours a day, the overall range extending from 0.00001507 to a minimum of 0.00001424, representing a volatility range of 0.00000083 (5.5%).

- The token found high resistance supported by the volume at 0.0000146 for 11:00 p.m. when the sales pressure intensified with a volume reaching 1.72 Billion, significantly above the average of 24 hours.

- After the sharp decline, SHIB established a consolidation model between 0.00001440 and 0.00001456, with several support tests at 0.00001440 showing the buyer’s interest, suggesting potential stabilization before the following directional movement.

- During the last hour, SHIB underwent significant drop pressure, from 0.00001448 to 0.00001440, representing a drop of 0.56%.

- The token was faced with an intense sale between 13: 54-13: 57, with a volume at 16.45 Billions at 1:57 p.m., creating a local background at 0.00001430.

- A brief recovery attempt occurred at 2:01 p.m. when the price rebounded at 0.00001441, forming a potential support area between 0.00001439-0.00001440, although the momentum remains a lowering as evidenced by the inability to recover the level of resistance of 0.00001445.

External references