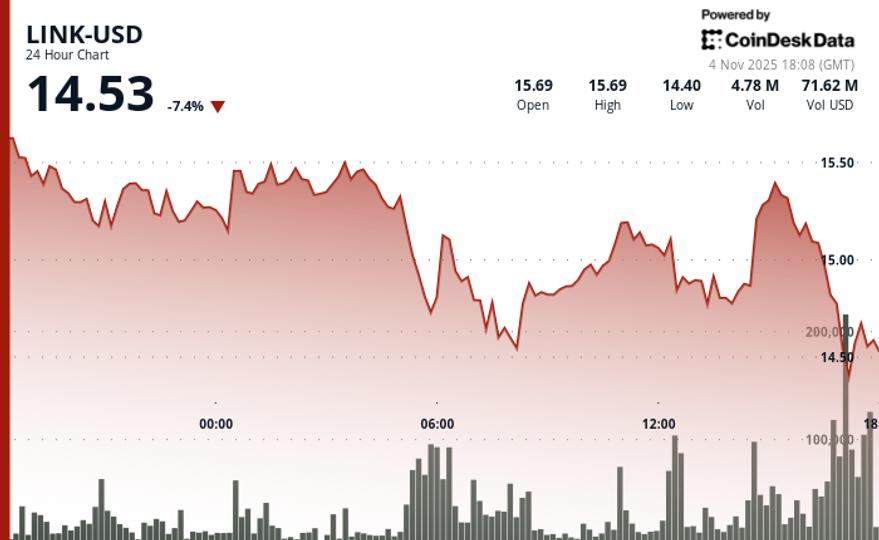

Native token of the Oracle Chainlink network On Tuesday, the price broke through key technical support levels, falling 6% to below $14.50, according to CoinDesk data.

The decline accelerated with massive volume surging 57.81% above the seven-day average, signaling aggressive distribution rather than short-market selling, CoinDesk Research’s technical analysis model noted.

Price weakness has diminished despite announcements of major institutional partnerships that would typically fuel rallies.

Swiss banking giant UBS has completed the world’s first end-to-end tokenized funds transaction using Chainlink’s Digital Transfer Agent standard. Meanwhile, FTSE Russell announced plans on Monday to bring the Russell 1000, 2000 and 3000 indices onto the blockchain by leveraging Chainlink’s DataLink services.

Technical Weakness vs Banking Adoption: What Traders Should Watch For

While major partnerships have failed to prevent support from breaking down, LINK demonstrates how short-term technicalities often trump fundamental developments.

The decisive break below the $15.26 support level occurred during the morning session on an exceptionally high volume of 4.69 million tokens, establishing a clear descending channel that accelerated into the close.

The final hour of trading proved particularly destructive as LINK fell from $15.22 to $14.70 on massive volume exceeding 3.5 million tokens. The breakdown confirmed the broader bearish structure while potentially creating oversold conditions for any recovery attempts.

Key Technical Levels Signal Further Downside for LINK

- Support Zones: Critical test in the $14.50-$14.60 demand zone after a breakdown.

- Volume Analysis: A 57.81% increase above the seven-day average validates the breakdown movement.

- Chart Patterns: The Formation of a Descending Channel Confirms a Shift in Bearish Dynamics

- Targets and Risk: Further weakness towards $14.00 likely before stabilization occurs.

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance. our standards. For more information, see CoinDesk Comprehensive AI Policy.