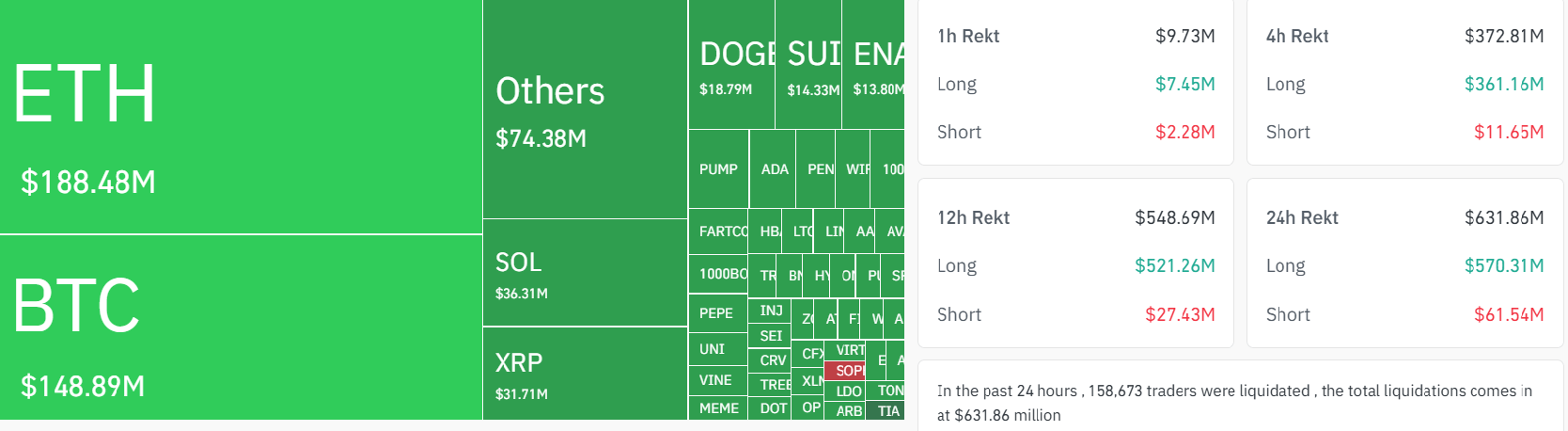

Cryptographic markets have experienced lively volatility in the last 24 hours, with more than $ 630 million in liquidated leverage positions through exchanges.

Most of the damage came from long, which represented more than $ 580 million in total liquidations, because the traders were captured out of the past game during a brutal intraday sale.

Bitcoin (BTC) fell to $ 115,200, erasing some of its recent gains, but maintaining a relatively stable posture compared to other majors. Its domination increased slightly while altcoins carried the weight of the correction.

Ether (ETH) fell to $ 3,687, while XRP (XRP) traced less than $ 3 despite large recent titles. Solana (Sol) fell to $ 170 and BNB (BNB) spent $ 780 after a last week record that dropped over $ 855.

Coinglass data show that the largest liquidation was a period of $ 13.7 million on the Binance.

Liquidations occur when traders using the lever effect (funds borrowed) are forcibly closed out of their positions because their warranty falls below the required maintenance thresholds. This generally amplifies the volatility of prices, in particular in short deadlines, because the liquidated positions create a sudden sale or purchase pressure depending on the side of the trade.

For merchants, liquidation data give an overview of the feeling of the market and the risk of positioning. High liquidation totals – particularly concentrated in a direction (for example, long) – often signal an overextensible positioning. This may indicate possible inflection points or imminent inversions as the market resets.

Monitoring thermal cards and real -time liquidation financing rates can help traders identify forced sales or purchase areas, often around key support / resistance levels, time entries or outputs during high volatility zones and gauge market lever and risk behavior / deactivated

Speculative altcoins have been particularly affected. The Solana-Ecosystem tokens such as Fartcoin (Fart), Pump.fun (Pump) and Jupiter (JUP) all faced abrupt intrajournial corrections.

“We observe that tokens like Fartcoin and Pump.

“Recent corrections – the PET falling by 14% to retest its EMA at 100 days almost $ 1, JUP losing support for its 200 -day EMA, and Pump which was pursuing its slide in a downhill channel – seem to come from the profit and momentum in the short term, not a systemic market change.”

Lee added that the relative force of Bitcoin, supported by ETF inputs and macroeconomic stability, strengthens the view that the withdrawal is isolated, not based.

Bitcoin holding above $ 115,000 remains the anchor of the market. Unless this level breaks, the wider structure remains intact.