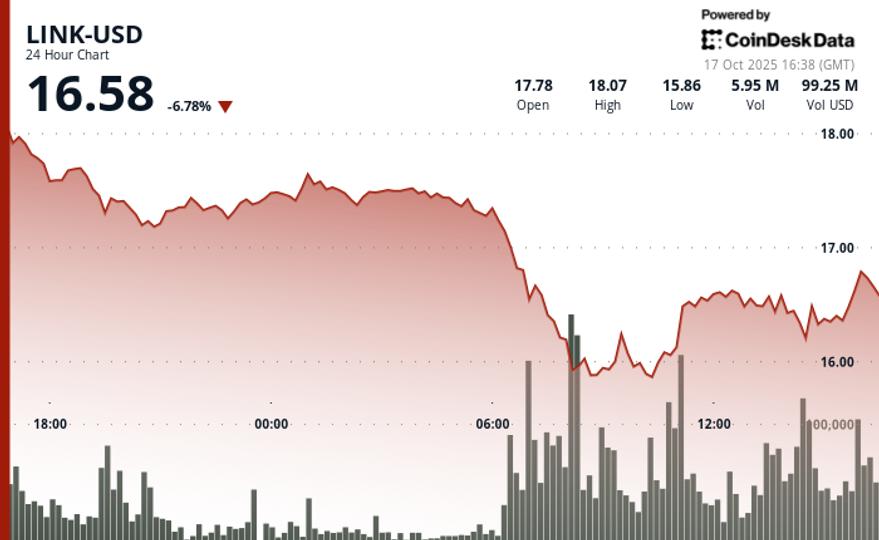

The native token of the Oracle Chainlink network fell sharply on Friday, dropping nearly 9% to $16.46, its lowest price since last Friday’s crypto crash.

The pullback occurred amid concentrated selling pressure, particularly between 6:00 a.m. and 8:00 a.m. ET on Friday, CoinDesk Research’s analysis model noted. A brief rally late in the session saw LINK edge up 0.4% in the final hour, but not enough to offset earlier losses.

Despite this sharp decline, corporate interest in LINK appears to be stable. Caliber Corporation (CWD), a Nasdaq-listed real estate investment company, announced an acquisition of LINK for $2 million on Thursday. This purchase brought Caliber’s LINK total to 562,535, worth approximately $9.2 million at current prices.

Meanwhile, the Chainlink reserve added another 59,969 LINK to its holdings, bringing its holdings to 523,159 tokens. However, with an average base cost of $21.98, the reserve remains deep underwater, down more than 34% from its entry point.

On the technology front, Chainlink advanced its product roadmap with the launch of Data Streams on MegaETH, a high-throughput blockchain optimized for real-time applications. The integration allows smart contracts to access live market data with sub-second latency, supporting DeFi use cases such as perpetual swap trading and stablecoins with centralized speed at the exchange level.

Technical Analysis Breakdown:

- Chainlink saw a massive sell-off, dropping from $18.07 to $16.46, representing a substantial 9% sell-off with an overall trading range of $2.25.

- Critical institutional support emerged at the $15.72 to $15.82 area with strong volume confirmation, while resistance formed at $17.43 with multiple rejections throughout the trading session.

- LINK established a new support level around $16.30 to $16.35 as potential re-entry strategies.

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance. our standards. For more information, see CoinDesk Comprehensive AI Policy.