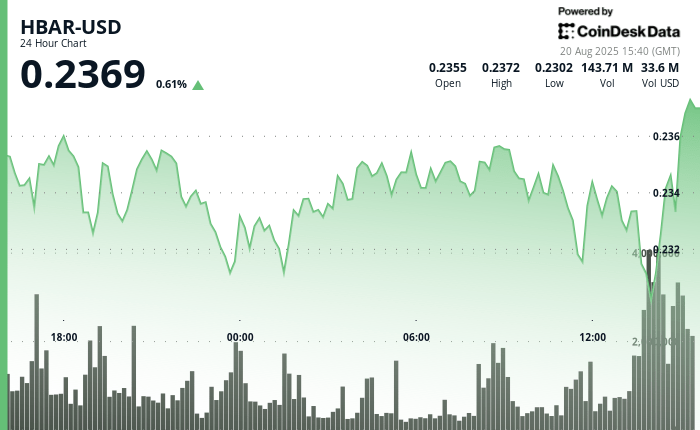

The Hedera Hashgraph Hbar token was faced with high sales pressure during a volatile section of 11 p.m. between August 19 at 3:00 p.m. and August 20 at 2:00 p.m., from $ 3% to $ 0.23.

The token exchanged in a tight band of $ 0.01, marking a propagation of 4% between its high and low session, because the traders adjusted the exposure through alternative digital active ingredients. Analysts highlighted the level of $ 0.24 as a key point of resistance, where the purchase of the ’Élan was and the pressure down has intensified.

The most pronounced activity occurred during the last hour of negotiation on August 20, when volumes increased to 85.82 million Hbar.

The market observers noted that the token had dropped to $ 0.23 before staging a modest recovery in the fence, a model that highlighted high volatility. The heavy renewal during this window suggests that the sellers were dominant, creating short -term weakness and testing key support levels.

Between 1:45 p.m. and 2:06 p.m., more than 3.8 million tokens have changed hands, coinciding with the highest part of the decline. The prices briefly plunged on the lower session before rebounding, because the purchase of interest has reappeared to stabilize the market.

In the last minutes, Hbar has recovered enough to close almost $ 0.23, indicating that although downward risks remain, short -term support is for the moment.

Technical indicators analysis

- The token decreased by 3% of the opening price of $ 0.24 at the closing price of $ 0.23 over a period of institutional sale of 23 hours.

- The negotiation range of $ 0.01 represents a propagation of 4% between the high and low absolute session.

- The level of resistance established about $ 0.24, when institutional purchase interest has decreased considerably.

- The level of support emerged almost $ 0.23 with retail purchases offering a technical floor.

- A high volume of 85.82 million during the last hours confirms institutional distribution models.

- The volume exceeded 3.8 million during the peak sale period between 13: 45-14: 06 indicating a coordinated liquidation.

- The 14 final minutes showed a technical recovery from the level of support of $ 0.23 suggesting retail purchase interest.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.