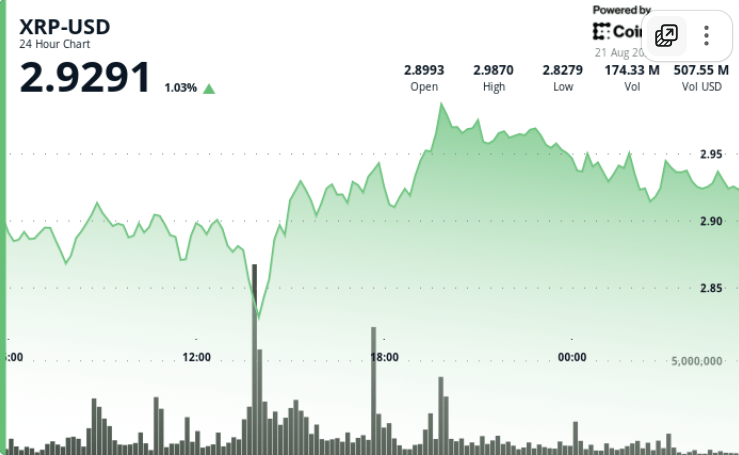

XRP balanced almost 6% during a 24 -hour volatile session, bouncing steep losses at $ 2.82 to settle at $ 2.93. This decision was fed by an increase in volume and purchase of aggressive support, even if the whales are discharged and the larger markets absorbed $ 360 million in liquidations.

New context

- XRP was faced with the sale of pressure in the middle of a blockchain safety gradient which raised concerns concerning potential vulnerabilities.

- The whales cohorts were active on both sides – some accelerating sales in gatherings while others defended critical support levels.

- Larger Crypto markets have seen $ 360 million in liquidations while institutions were running out of risky assets, weighing the feeling through the majors and the same.

- Technical analysts continue to point to $ 3.17, because the escape zone which could unlock a net rally to $ 5.00 +, although the lower camps warn against a slide at $ 2.65 if the supports break.

Summary of price action

- XRP tilted 5.69% between August 20 and 21, the sculpture of a variety of $ 0.17 from $ 2.82 to $ 2.99.

- The token collapsed at the lower session during the UTC window from 1:00 p.m. to 3:00 p.m. before retaining a net counterattack at $ 2.93.

- The volume increased to 155 million during the recovery time of 2:00 p.m. – almost triple of the daily average of 63 million.

- Bears defended the resistance of $ 2.99 aggressively, but Bulls anchored the offers at $ 2.82, forcing a rally at the end of the session.

- XRP closed the session at $ 2.93, Momentum tilted towards the bulls on a solid volume confirmation.

Technical analysis

- Support zone: Buyers defended $ 2.82 with a high conviction, validating the soil on high flows.

- Resistance wall: The sellers crowned movements at $ 2.99, fixing a clear ceiling.

- Volume overvoltage: 155 million bearings during the recovery – 2.5x daily average – Mark the purchase of institutional size.

- Intrajournal model: V -shaped V -shaped from $ 2.82 to $ 2.93, the signaling accumulation interest.

- Morning session: XRP extended the gains by 0.34%, going to $ 2.94 with time volumes of 580,000 against a standard of 470,000.

- Momentum Outlook: The supply flows supported from $ 2.92 to $ 2.93 suggest the escape pressure.

What traders look at

- That XRP can crack and maintain above $ 2.99, unlock $ 3.17 as the next escape target.

- Positioning trends for continuous whales – in particular distribution signs compared to accumulation around $ 3.00.

- Larger market repercussions, with liquidations and an appetite for institutional risks dictating short -term flows.

- If $ 2.82 takes other tests, the definition of sustainable soil before a possible increase in the rise.