Dogecoin joined Tuesday after a series of regulatory and corporate catalysts moved feeling through the cryptography sector. An acquisition of $ 50 million in Trump from a DOGE extraction company, the launch by Wyoming of a stablecoin to support the state, and the comments of the federal reserve managers signaling a softer position on the digital assets all converged to trigger new institutional flows.

New context

• Thumzup, an entity affiliated with Trump, has acquired Dogehash for $ 50 million, creating what managers have described as Doge’s largest operating operation. The agreement signals in -depth confidence in the infrastructure of Dogecoin.

• Wyoming has unveiled the stable border token, the first stablecoin of the government supported by the government, strengthening the American regulatory pivot to digital assets.

• FED vice-president Michelle Bowman warned the competitive risk banks to delay the adoption of digital assets, signaling a more crypto-acccomante posture.

• Sofi Technologies has integrated the Lightning Network of Bitcoin, targeting the shipping market of 740 billion dollars – another traditional financing signal more deeply in cryptographic rails.

Summary of price action

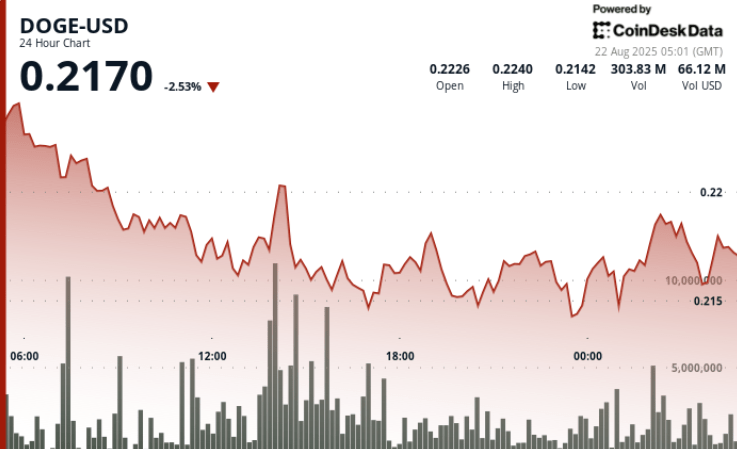

• DOGE exchanged in a band of $ 0.01 from $ 0.21 to $ 0.22 between August 20 3:00 p.m. and August 2:00 p.m., marking ~ 4 to 5% intraday volatility.

• The token gathered from $ 5% to $ 0.21 to $ 0.22 during the August 20 session, establishing $ 0.22 in short -term resistance.

• A 60-minute window at the end of the session (August 21, 13: 22-14: 21) saw DOGE increase by $ 1% from $ 0.22 to $ 0.22 with volume peaks over 61.8 million, confirming institutional activity.

• Support is systematically held in the area from $ 0.21 to $ 0.22 with rebound on 320 to 380 million volumes on the main test points.

Technical analysis

• Support: $ 0.21 to $ 0.22 established as a reliable floor with repeated high volume reestes.

• Resistance: $ 0.22 Pivot stored, but the bulls need to follow around $ 0.225 to confirm the escape.

• Volume: Cutting -edge overvoltages of 61.8 million and 378.6 million confirm the interest in institutional purchase.

• Model: Classic consolidation followed by an impulsive rupture; Touring up if the support base is maintained.

• Future oi: Stable of around 3 billion dollars, reflecting leveraged interests supported despite the macro-voltility.

What traders look at

• If DOGE can maintain above the pivot of $ 0.22 and push towards $ 0.225 to $ 0.23 of resistance.

• The reaction of the market to Fed policy changes and the launch of the Wyoming stable reserve – potential rear wind on the sector scale.

• Whale accumulation models, already totaling 2 billion Doge ($ 500 million) this week.

• The expansion of the mining sector via the acquisition of THUMZUP and its impact on the distribution of the chopping power of DOGE.