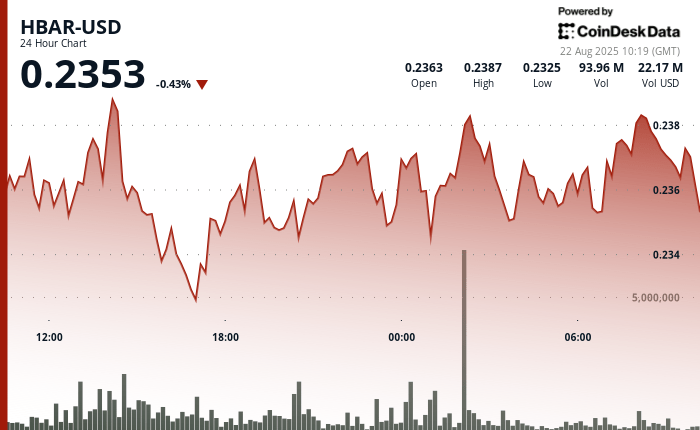

The native token Hbar of Hedera is testing a key support at $ 0.23 after being sold by more than 3% on Friday.

The volume of negotiation increased beyond 80 million during crucial intraday windows on August 21.

Despite the sale, Hbar has a number of bullish catalysts; Swift revealed its intention to launch live blockchain payment tests with Hbar in its annual payment network of 150 billions of dollars from November 2025.

At the same time, speculation on a potential fund negotiated on the stock market has gathered steam after Graycale has deposited Delaware trust documents linked to Hbar. These developments highlight the capacity of Hashgraph technology to deal with more than 10,000 transactions per second, strengthening the confidence of investors in its role in the transformation of traditional financial infrastructure.

With the global integration of payments on the horizon, Hbar continues to attract institutional interests as a technical and fundamental game.

Technical analysis

- $ 0.01 The negotiation range creates a volatility of 2.40% between $ 0.24 of resistance and support levels of $ 0.23.

- Volume explosions exceed 80 million keystock reversal points during noon trading sessions.

- The support is firm, for the moment, at $ 0.23 while the resistance accumulates almost $ 0.24 price targets.

- Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.