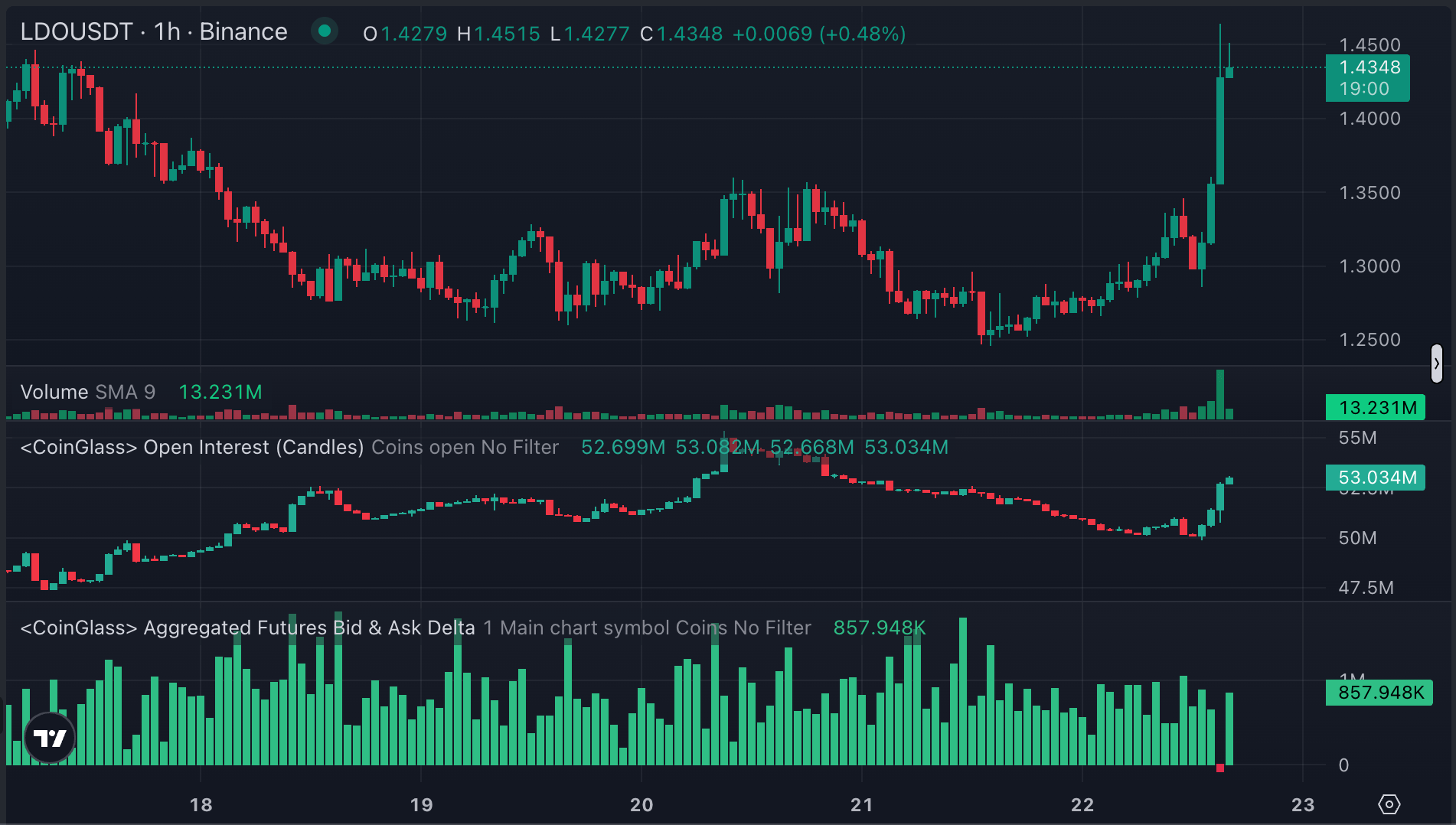

Friday, Crypto traders bought the dive in several Ethereum tokens that rush, lifting tastes of Lido (LDO) and Ethena Right up 14% and 15%, respectively.

The gains follow a drop of a week which took place in parallel with a rapid change in feeling, which is generally a signal to buy.

Lido and Ethena return to the summits of last week after a rally in early August stimulated by the Declaration of Securities and Exchange American Commission according to which the liquid implementation protocols are not titles.

SEC Declaration was considered optimistic for decentralized finance (Challenge) The ecosystem, in particular for the protocols based on Ethereum which depend on implementation mechanisms to generate a yield.

Clarity also opened the valves to institutions, the domination of the figure over other protocols for the layoff of liquids suggesting that institutional entries were starting to drive the sector.

The negotiation volume for trading pairs ENA has doubled in the last 24 hours to 1 billion dollars, while LDO increased by $ 256 million, according to CoinmarketCap.

The rise in volume coupled with Bitcoin And ether (Eth) The capacity to maintain key support augurs well for the Altcoin sector in general, although it should be noted that the queue of the Ether validator remains extremely high at 825,580 ETH ($ 3.8 billion).

When these ether tokens are not ready, they can be sold on the free profit market, or marked elsewhere to generate a higher yield – the first would probably stop other upward movements.