XRP increased by 3% while the president of the federal reserve Jerome Powell firmly dropped a September rate on the table on Friday, causing the mounting of Bitcoin (BTC) and major tokens.

470 million token tokens led volume peaks and high resistance to $ 2.92, while ETF delays and low safety rankings make up the bearish pressure.

New context

• Institutional liquidations dominated the exchanges, because 470 million XRP were discharged on the main exchanges during the window from August 21 to 22, triggering a strong sale.

• Chain settlement volumes jumped 500% to 844 million tokens on August 18, one of the largest peaks this year, signaling the growth of adoption despite the weakness of the market.

• The SEC has postponed decisions on ETF XRP applications, including the deposit of Nasdaq coinshares, now expected in October. Delay adds to regulatory uncertainty.

• An evaluation of security has placed XRPL in the lowest ranking among 15 blockchains, which raises concerns concerning the robustness of the network and adding to the lower feeling.

Summary of price action

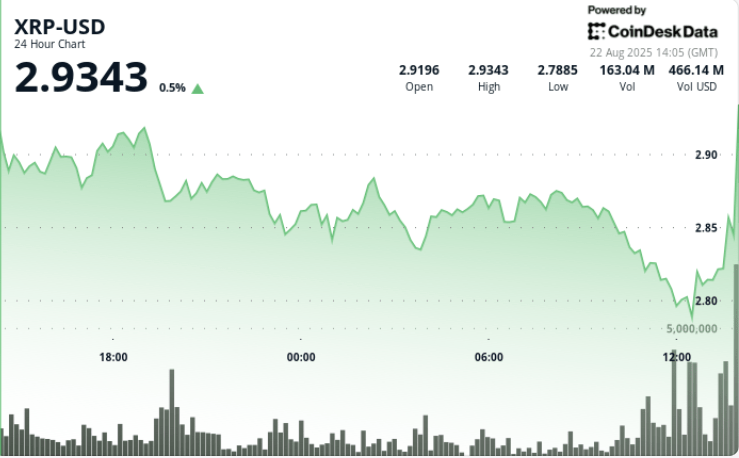

• XRP decreased by 3.1% during the 24 -hour session from August 21 to August 22 at 12:00 p.m., from $ 2.89 to $ 2.80.

• The token varied by $ 0.12, a volatility band of 4.25%, between a peak of $ 2.92 and a hollow of $ 2.80.

• The clearest movement occurred at 7:00 p.m. on August 21, when XRP was rejected at $ 2.92 over a volume of 69.1 million, confirming major resistance.

• Last hours trading (August 22, 11: 24-12: 23) saw XRP drop by $ 2.82 to $ 2.82 to $ 2.80 over a growing volume of 7.2 million, confirming the downward continuation.

• Support emerged nearly $ 2.80 to $ 2.85, but the accumulation interest was weakened with each retest.

Technical indicators

• The resistance hardened at $ 2.92 on the volume rejection of 69.1 m.

• Management identified in an area from $ 2.80 to $ 2.85, while weakening repeated tests.

• The volume increased to 96 m at 11:00 am on August 22, confirming the lowering follow -up.

• The negotiation range of $ 0.12 (4.25%) highlights the concentration of volatility.

• Last hour sale of 2.5% with a volume of 7.2 million validated lower lower.

What traders look at

• If $ 2.80 can contain as a support; A rupture risks acceleration to $ 2.75.

• The titles linked to ETFs, with key October decisions of broader institutional flows.

• Whale accumulation models – Adoption in increasing chain, but the price does not reflect the fundamentals.

• $ 2.92 in the resistance area of $ 3.00 as a rupture trigger for a Haussier reversal.