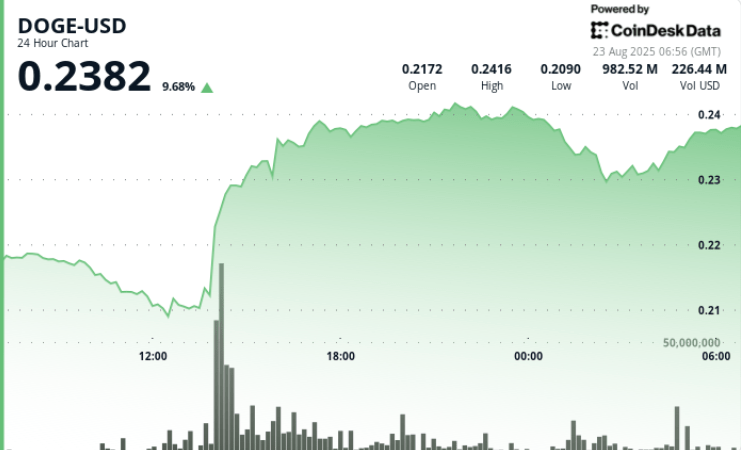

The same token climbs to $ 0.24 peak with the volume doubly of the monthly averages, signaling the institutional activity behind the rally.

New context

• The federal reserve reported a softer position on cryptographic banking rules, while Wyoming launched the first stablecoin to support the state. The two developments have raised the feeling around digital assets.

• The entity linked to Trump Thumzup has completed an acquisition of $ 50 million from the Dogecoin Dogehash extraction company, forming what managers claim to be the largest DOGE extraction operation.

• Sofi has become the first American banking institution to integrate the Bitcoin Lightning network for funding, strengthening the broader institutional adoption of cryptographic infrastructure.

• Whale portfolios have accumulated 680 million DOGE tokens until August, cementing growing institutional flows despite the volatility of retail.

Summary of price action

• DOGE joined 8% during the session from August 22 to 23, from $ 0.22 to $ 0.24 in a range of $ 0.02.

• The clearest movement arrived at 2:00 p.m. GMT on August 22, when DOGE went from $ 0.21 to $ 0.23 over a volume of 4.27 billion, almost quadruple the hourly average.

• The support is now $ 0.21 after a successful retest, while the resistance has capped gains at the psychological level of $ 0.24.

• An end -of -session wave added 1% from $ 0.23 to $ 0.24, with a volume peak from 28.1 m to 04:52 GMT confirming the accumulation.

• Prices’ action shows higher consecutive stockings, which suggests sustained purchase pressure and potential prosecution of trends.

Market analysis

Doge’s escape aligns with a broader cryptography rebound as risk appetites has improved between digital actions and assets. The combination of the recalibration of the Fed policy, the adoption of stablecoin at the level of the State and a large -scale acquisition amplified institutional participation to a token often considered as purely focused on retail.

The level of $ 0.24 remains a critical inflection point. A sustained break could open dynamic objectives around $ 0.26, while the risk of failure renewed repetitions of $ 0.21 in support.

Technical indicators

• 24 hours a day from 8% from $ 0.22 to $ 0.24 with $ 0.02 negotiation range.

• The volume increased by 97% above the average of 30 days with 4.27 billion chips exchanged.

• Confirmed care at $ 0.21 after the intraday Restst.

• The resistance hardened at $ 0.24 per psychological threshold.

• consecutive upper stockings point to an upward structure.

• A rise in volume from 28.1 m to 04:52 GMT validates institutional flows.

What traders look at

• If DOGE can establish $ 0.24 as a support for an $ 0.26 escape.

• Trends being accumulated by whales from potential retail profits to resistance.

• Impact of the launch of stablecoin supported by the state of Wyoming on the same ascoin liquidity flows.

• The reaction of interest opened in the long term after a rally of heavy points.