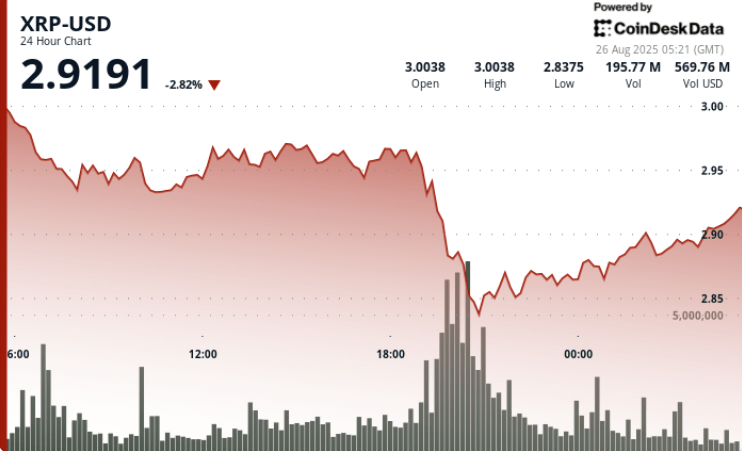

XRP faced steep oscillations in the negotiation window from August 25 to 26, from $ 3.01 to $ 2.91 for a loss of 3.2%. An explosion of institutional liquidation during hours from 7:00 p.m. to 8:00 p.m. led to the strongest decline, with volumes tripling the daily averages. The recovery attempts at the end of the session brought the token over $ 2.90, but the market remains divided on the question of whether the upward momentum can support.

New context

- XRP exchanged with high volatility until August, with repeated failures greater than $ 3.00.

- Whale portfolios and institutional flows have led to short -term oscillations, adding pressure on retail positioning.

- Wider crypto references displayed lighter gains, leaving XRP to dragging peers in the middle of the regulatory overhang in the United States

- Crypto Exchange Gemini, founded by Cameron and Tyler Winklevoss, told Coindesk that he joined Ripple to launch an XRP edition of his credit card in partnership with Webbank.

- The card offers up to 4% cashback in XRP on fuel, EV load and carpooling, 3% on meals, 2% on grocery store and 1% on other purchases. Gemini said that he also worked with certain merchants to offer up to 10% return to eligible expenses.

Summary of price action

- XRP decreased by $ 3.24% to $ 2.01 in $ 2.91 in 24 hours, in a range of $ 0.28 (volatility of 9%).

- Headlight sales took place between 19: 00 and 20: 00 GMT while XRP increased from $ 2.96 to $ 2.84 out of 217.58 million volumes, well above the daily average of 72.45 million.

- The token rebounded 0.69% during the time of final negotiation, from $ 2.89 to $ 2.91 with institutional flows on average from 641,000 per minute.

Technical analysis

- The resistance confirmed at $ 2.96, aligning with the rejection of the Bollinger upper band.

- Support built from $ 2.84 to $ 2.86, in accordance with the 20 -day mobile average area.

- $ 2.89 The Intraday floor shows the accumulation, with RSI recovering from 42 occurrences in the mid -1950s, which suggests stabilizing the momentum.

- The MacD histogram shrinking towards a bullish crossing, signaling the shift in the potential of the short -term trend.

- Supported exchanges greater than $ 2.90 necessary to open the way around $ 3.20 to $ 3.30; Break below $ 2.84 the risks slide to a support of $ 2.80.

What traders look at

- The bulls target $ 3.70 if the momentum extends and the volumes normalize.

- Bears signals $ 2.80 as a breakdown that could speed up losses.

- Institutional absorption remains the key – if the big players continue to support offers from around $ 2.89 to $ 2.90 will dictate the next step.