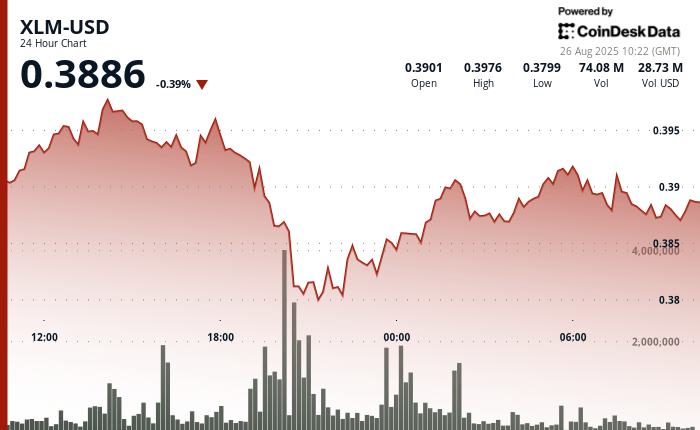

The native token XLM of Stellar faced an intense pressure in the last 24 hours, plunging from a session of $ 0.398 to a minimum of $ 0.380. The 5% swing took place in the middle of a strong sales activity, with the most spectacular capitulation striking on August 25 at 7:00 p.m. UTC, when prices went from $ 0.393 to $ 0.387. This movement coincided with an overvoltage of 46.16 million tokens changing the hands – well above the daily average – effectively locking $ 0.393 as a formidable resistance zone.

The sale reached its peak an hour later while XLM tested the level of support of $ 0.380 over an unprecedented negotiation volume of 95.27 million tokens, confirming the level as a critical defense line for the bulls. Despite the pressure, the token rebounded at the end, rising to $ 0.389 by the end of the session and highlighting the resilience of buyers’ demand at $ 0.380.

The feeling of the market is also shaped by broader developments. A recently deposited American crypto ETF aims to highlight local digital assets, especially stellar, potentially opening the door to new waves of institutional capital. At the same time, the technical models suggest that XLM rolls up under a major level of resistance almost $ 0.50, traders looking at the possibility of an escape if the momentum is up.

The intra -day negotiation action highlighted this tension. Between 07:20 and 08:19 UTC on August 26, XLM sailed in a narrow strip between $ 0.387 and $ 0.392, recording a modest gain of 0.18% of its open session. The brief rally at $ 0.392 was propelled by high volume purchase gusts, but a dynamic capped for lucrative. With volumes up 115% over the day at $ 402 million, the confrontation between high sales pressure and a potential whale accumulation remains the decisive narrative of the short -term trajectory of Stellar.

Technical indicators analysis

- Battlefield price: $ 0.018 representing a brutal war zone of 5% of $ 0.398 maximum at minimum $ 0.380 during the 24 -hour combat period.

- Nuclear explosion in volume: 95.27 million units exploding $ 0.380 in support support, 115% of negotiation ammunition above average.

- Fortress of resistance: impenetrable wall established at $ 0.393 with 46.16 million unit volume confirmation artillery.

- Strongers support: The Fortress of Critical Mission Request confirmed $ 0.380 with a massive volume validation firepower.

- Recovery offensive: Systematic advance to $ 0.389 after the support test with a strategically decreasing volume.

- Chaos Intraday: 5% volatility fork indicating an extreme market war and an institutional battle activity.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.