Digital Asset Manager Bitwise is preparing to launch a fund exchanged by stock market based on (ETF) focused on the maintenance of the Chainlink native token A first in the United States

According to the S-1 registration declaration filed Tuesday with the Securities and Exchange American Commission, the ETF Bitwise Chainlink aims to provide investors with a direct exposure to Link and the Coinbase custody appointed as a guard proposed for the tokens.

The deposit is part of a broader trend of asset managers seeking to launch FNB spots focused on Altcoin in the United States while the regulatory opposite winds steep under the Trump administration, after the success of Bitcoin and ether (Eth) vehicles.

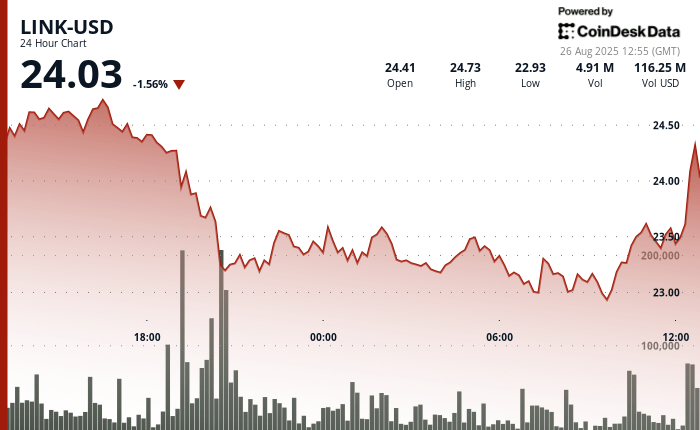

Link has rebounded 5% compared to night stockings on news, but has always dropped by 1.6% in the last 24 hours, according to Coindesk data.

Despite the rebound, the Coindesk Research technical analysis model suggested a low -cost pressure for the link while the cryptography market goes through a consolidation period.

Link encountered substantial drop pressure in the last 24 hours, going from a session peak of $ 24.81 to a minimum of $ 22.90.

A significant recovery effort has surfaced for 10:00 a.m. to 11:00 a.m. UTC, coinciding with the deposit of the ETF, because the price gathered from $ 23.02 to $ 23.54 over an increased volume of 3.35 million units, indicating possible consolidation above the crucial psychological threshold of $ 23.00.

The model suggested that recovery of the $ 24.00 level is the key to interrupting the downward dynamics, while the recent rebound implies that surveillance conditions can attract investors in search of value.

The technical indicators indicate a momentum

- The price decreased by $ 24.67% to $ 24.61 to $ 23.46 in the last 24 hours of August 25 from August 12 to 26 UTC.

- Commercial range of $ 1.84 between $ 24.81 and a minimum of $ 22.90.

- The volume increased to 6.58 million units, which is significantly greater than an average of 24 hours of 2.29 million.

- Strong resistance established about $ 24.30 with support close to $ 23.00.

- Failure to comply with $ 24.00 indicates a continuous lower feeling.

- Break less than $ 23.40 The level of support suggests an additional risk for $ 23.00.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.