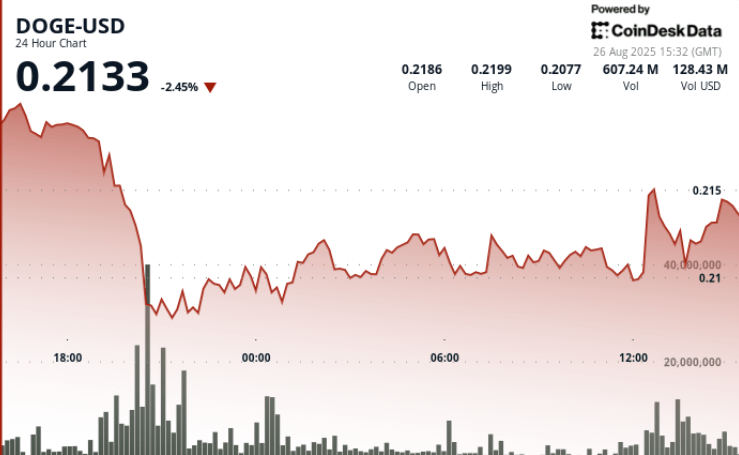

Dogecoin exchanged with strong volatility compared to the window from August 24 to 26, swinging in a range of $ 0.013 before consolidating almost $ 0.21. A sharp drop from $ 0.218 to $ 0.208 on August 25 occurred in the middle of a massive volume of 1.57 billion, while a larger pressure was linked to a transfer of 900 million Doge to Binance which disturbed the merchants.

Despite short -term caution, whales continue to accumulate, leaving the divided feeling between the risk of distribution and the purchase optimism of diving.

New context

- Whale transfers have added fuel to volatility: between August 24 to 25, only one 900 million Doge (200 million dollars) were transferred to Binance from a long -term maintenance portfolio.

- The feeling of the market has embittered the fears of a sale, with an open interest in the term contracts on DOGE, lowering 8% while speculative traders have carried out an exhibition.

- Despite the influx, the data on the chain show that the whales accumulated more than 680 million Doge in August, counter-distribution.

- Jackson Hole’s comments from the Fed Powell chair sparked a rally in the parts of 12%, aligning Doge with a wider momentum.

Summary of price action

- DOGE displayed a spread of 6.06% during the 23 -hour session ending on August 26 at 12:00 p.m., negotiating between $ 0.221 and $ 0.208.

- The clearest decision occurred from 7:00 p.m. to 8:00 p.m. GMT on August 25, when DOGE went from $ 0.218 to $ 0.208 on 1.57 billion volumes.

- The price also made its doors after the transfer of whales, going from a summit of $ 0.25 to test the support of $ 0.23 before stabilizing.

- A rebound raised Doge from $ 0.210 from a session to $ 0.211 to $ 0.212 in the window of 11: 27–12: 26 GMT on August 26, helped by an increase of 17.85 million volumes at 11:58 am.

Technical analysis

- Support established at $ 0.208 after the drop in high volume.

- The resistance is maintained from $ 0.218 to $ 0.221, ceiling gatherings.

- Current consolidation between $ 0.210 and $ 0.212 suggests an accumulation.

- RSI recovered from 42 in the mid -1950s, showing stabilizing momentum.

- The MacD histogram shrinking towards the Haussier crossing, signaling an inversion upside down of the potential.

- A drop in open interests of 8% of points to a reduced speculative lever effect, limiting volatility but also to alleviate the short -term increase.

- Extended exchanges greater than $ 0.21 with high volumes (+ 16% against the 30 -day averages) strengthen the optimistic case.

What traders look at

- The bulls target an escape around $ 0.23 to $ 0.24 if the consolidation is resolved upwards and the purchase of whales persists.

- Bear highlight $ 0.208 as a key trigger, with a risk of break -up to $ 0.200.

- The rope shooting between the exchange entries (risk of distribution) and the accumulation of whales (request for support) remains the decisive factor for the next leg.