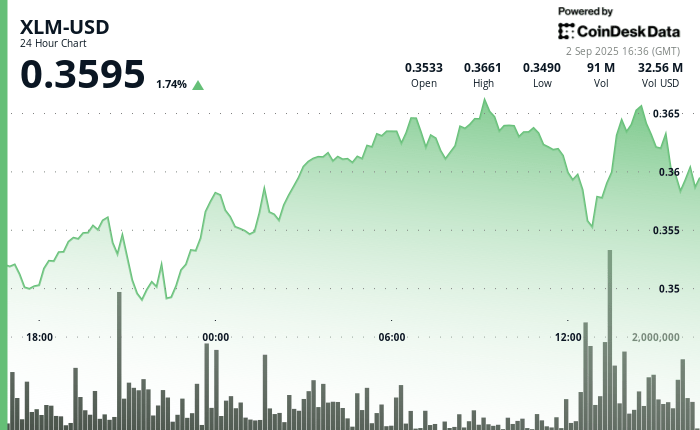

Stellar lumens (XLM) extended its recent gathering in the last 24 hours, climbing 3% while buyers absorbed increased sales pressure and pushed the token in new levels of resistance. Between September 1 at 3:00 p.m. UTC and September 2 at 2:00 p.m. UTC, XLM went from $ 0.36 to $ 0.36, with a volatility of 5% highlighting active participation.

The assets found the support at $ 0.35 following a brief wave of sales before consolidating itself in the range of $ 0.36. The resistance emerged around $ 0.37, where the market experienced two rejection points, although the volume trade above the daily average of 31.2 million tokens reported a sustained institutional interest.

The upward structure took place in the last hour of the session, when XLM gained 2% from $ 0.36 to $ 0.37. This decision was reinforced by a volume peak of 2.7 million units at 2:00 p.m. UTC, allowing the token to briefly pierce the ceiling of $ 0.37 before stabilizing $ 0.36. The escape has strengthened the trend 24 hours a day and suggested buyers build a basis for more than the increase if the momentum of the volume continues.

At the same time, the main South Korean exchanges Bithumb and Upbit said that they would suspend deposits and XLM withdrawals from September 3 at 9:00 am UTC. This decision is one of the preparations for upgrading the Stellar protocol 23, which aims to modernize the network infrastructure and extend interoperability.

Protocol 23 was designed as a step towards expanding Stellar’s utility for active active world, of which around $ 460 million is already circulating on the network. The synchronization of price gains with network improvements highlights an increasing story of the adoption of businesses.

The Technical Analysis model of Coindesk Data notes that consolidation greater than $ 0.36, combined with a systematic accumulation around key support levels, indicates the continuous institutional positioning which could open the way to a lasting passage beyond $ 0.37.

Market analysis reveals the strengthening of the interests of companies

- Price established fundamental support at $ 0.35 during increased sales pressure on September 1 9:00 p.m.

- A robust accumulation activity developed between $ 0.36 and $ 0.36 after a decisive market recovery.

- Resistance parameters identified at $ 0.37 at $ 0.37 when the price encountered double rejection events.

- The commercial volume increases an average of 31.20 million institutional participation validated on the market.

- Active management of consolidation in the training of ascending price channels.

- Rupture potential greater than $ 0.37 resistant depending on a validation of sustained volume.

- Trading dynamics accelerated for 13: 35-13: 46 session with a decisive upward movement.

- An improved support structure established about $ 0.36 to $ 0.36 in prices.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.