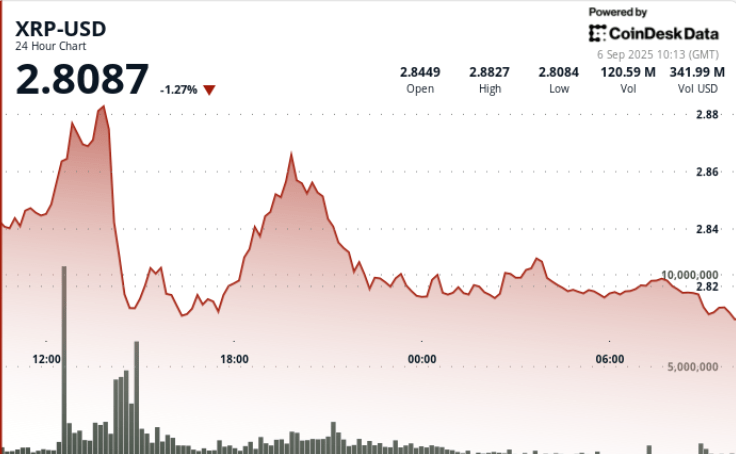

XRP failed to maintain the momentum greater than $ 2.88 to $ 2.89, triggering a drop of 4%, the institutional sale capped the advance. The heavy volume confirmed the resistance to these levels, while buyers reappeared in the range of $ 2.81 to $ 2.83 to stabilize prices.

This decision maintains XRP locked in a consolidation of 47 days of less than $ 3.00, the traders now considering the support pivot of $ 2.77 and the Dry ETF decisions of October as the following catalysts.

New context

- Six institutional asset managers filed ETF XRP requests to the accountant, with dry decisions expected in October.

- The accumulation of whales continues, with around 340 million tokens bought in recent weeks despite persistent volatility.

- The exchange balances remain high above 3.5 billion XRP, which raises questions of potential supply pressure if the sale of curriculum vitae.

- Changes in the federal reserve policy and inflation prints shape wider liquidity conditions between risk assets.

- Previous attempts to break up above 27.7 million tokens are negotiating nearly $ 2.88 to $ 2.89, confirming this area as firm resistance.

Summary of price action

- XRP exchanged in a range of $ 0.08 from $ 2.81 to $ 2.89, which represents a volatility of 3%.

- The highest decline occurred at 2:00 p.m. on September 5, from $ 2.88 to $ 2.81 on almost 280 million tokens exchanged.

- Stabilization followed, with a consolidation between $ 2.82 and $ 2.83 over a lighter volume.

- The fence price almost $ 2.82 maintained XRP just above the $ 2.77 support pivot, considered the next keys to the railing.

Technical analysis

- Support: a solid offer area identified at $ 2.77 at $ 2.81 after repeated defenses.

- Resistance: Immediate ceiling of $ 2.88 to $ 2.89, with a psychological level of $ 3.00 and a breakthrough threshold of $ 3.30 above.

- Indicators: RSI was in the mid -1950s, reflecting neutral bias in evil.

- The MacD histogram converges towards the Haussier crossing, signaling a possible change of momentum if the volume returns.

- Structure: Consolidation during 47 days in less than $ 3.00, with a fence greater than $ 3.30 opening the opening path to $ 4.00 +.

What traders look at

- Whether $ 2.77 is the decisive level of support if the sale of curriculum vitae.

- Price behavior on repetitions from $ 2.88 to $ 2.89 Resistance, especially if the volume exceeds daily averages.

- How the accumulation of whales compensates for the high exchange sales, which suggest a risk of latent supply.

- October decisions on ETF XRP Spot, considered as a key institutional adoption catalyst.

- Macro drivers from data versions on policy and inflation that can influence flows between digital assets.