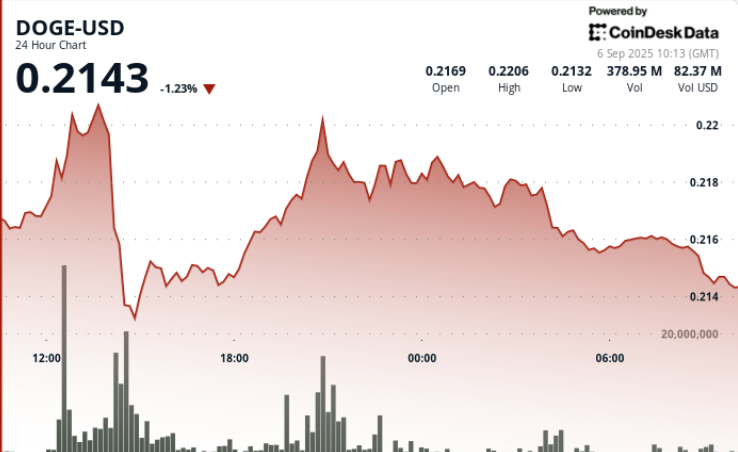

Dogecoin organized net price oscillations during the negotiation window from September 5 to 6, the increase of almost 1% while the volume jumped 29% above the weekly averages. A midday sale to $ 0.213 was quickly absorbed by buyers, emphasizing institutional support and speculation focused on FNB. Traders now consider $ 0.22 as the key break which could define the short -term momentum.

New context

• Dogecoin has reached a Local summit of $ 0.2157Its strongest level for weeks, with a commercial volume of 29.19% above weekly landmarks.

• The reports have surfaced a Treasury initiative of $ 200 millionDirected by Elon Musk’s legal advisor, stimulating institutional credibility.

• REX shares and Osprey funds would have filed the First FNB Dogecoin US applicationsWith decisions expected in October.

• The long -term activity jumped 119% in August, reflecting increased institutional positioning around memes digital assets.

Summary of price action

• Doge has exchanged Range of $ 0.008 (3.6%) Between $ 0.213 and $ 0.221.

• The highest movement struck at 2:00 p.m. when the price went from $ 0.220 to $ 0.213 on Volume of 1.31bestablishing robust support.

• Recovery raised Doge to $ 0.216 per session, buyers systematically defending the area from 0.213 to $ 0.214.

• The one hour window of 05: 13-06: 12 saw a Feeling exceeds $ 0.2157 on Volume of 3.06 millionAlluding to a renewed upward pressure.

Technical analysis

• Support: Strong base at $ 0.213 to $ 0.214, validated by a volume of 1.3 billion during the sale.

• Resistance: Clear ceiling at $ 0.220 at $ 0.221, with several refusals.

• Momentum: The $ 0.2157 escape attempt suggests a bullish continuation if $ 0.22 strives.

• Motifs: Signs of accumulation in a tight consolidation strip; The triangle descending on the Doge / BTC pairs broke upwards (reported by cryptokaleo).

• Indicators: Stable RSI near the mid -1950s (Neutral-bulsh); The MacD histogram converging on a potential bullish crossing.

What traders look at

• If Doge can Sustain closes above $ 0.22 To trigger an extended rally.

• Institutional flow linked to Treasury initiative of $ 200 million and potential FNB approval.

• Targets in small groups projected between $ 0.30 to $ 0.35 If the resistance clears; The risk of decline remains towards $ 0.21 support.