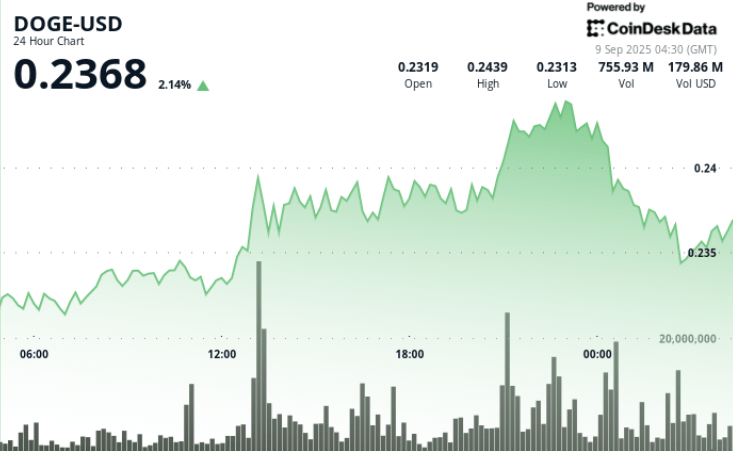

Dogecoin has swept away violently in the last 24 hours, with whales and institutional offices working in heavy volumes almost $ 0.234 in support. The samecoin increased by 2% in the last hour to recover from a strong intraday sale, although the resistance at $ 0.244 remains firm.

Summary of price action

• DOGE exchanged between $ 0.231 and $ 0.244 from September 8 at 04:00 to September 9 at 3:00 a.m., a range of 5.7%.

• Early dynamics brought the price to a peak of $ 0.244, but heavy inverted gains to profit by closing session at $ 0.236.

• Volumes increased to 463.5 million tokens during rejection at $ 0.244, showing a strong institutional sale.

• Support at the end of the session emerged between $ 0.234 and $ 0.237, with 687.9 million tokens exchanged, which suggests an accumulation.

• Last hour recovery doge from $ 0.234 to $ 0.237 (+ 1.3%) Because the volume was on average 6.2 m per minute.

Technical analysis

• Support: $ 0.234 to $ 0.237 Zone confirmed by heavy purchases in the end of the session.

• Resistance: level of $ 0.244 rejected several times on a large volume, capping the momentum upwards.

• Short -term momentum: highest stockings in the last 20 minutes indicate bias bias bruise trees.

• Key signal: The break of $ 0.244 could target $ 0.250, while the risk of failure re -designer of $ 0.231.

New context

• The term data show an increased open interest in Doge contracts while institutions hide exposure to the point.

• Market players anticipate American regulatory progress on cryptographic ETFs, keeping DOGE in speculative flows.

• Wider volatility stems from the political expectations of the Fed and global trade tensions with an impact on risk assets.

What traders look at

• The fact that Doge can keep closes above $ 0.240 and return $ 0.244 in support, the opening path to $ 0.250.

• How the decision of the September 17 rates of the Fed has an impact on the conditions of appetite and liquidity of the risks through the crypto.

• Whale wallet dishes, with observed institutional offices accumulating during the dips at the end of the session.

• Progress on the deposits of ETFs linked to American DOGEs and if regulators report lighter advice on memes currency products.