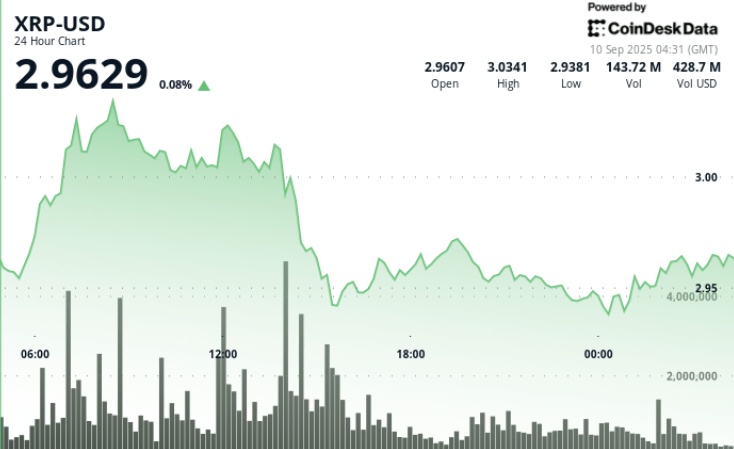

XRP struggled to maintain a momentum above the $ 3.00 threshold from September 9 to 10, with a strong institutional sellers destroying the first gains. Despite a thrust at $ 3.035, the liquidation managed by the volume has erased attempts up and withdrawn the asset to $ 2.94 per session.

This decision indicates mounting resistance nearly $ 3.02, even if traders weigh the ETF catalysts and the increase in exchange reserves which can temper the optimistic momentum.

New context

• The meeting of the federal reserve of September 17 should make a price drop of 25 points, with markets which attribute a quasi -certainty to the result – a potential liquidity engine for risk assets.

• Six ETF SPOT XRP applications await a dry examination in October, decision -making traders consider a pivot for institutional adoption.

• The exchange for exchange for XRP have reached a 12 -month peak, which raises concerns about short -term sales pressure despite the whale accumulation models in recent weeks.

• Analysts note the parallels with the failure of the July rupture of XRP, which suggests that the market structure is again tested at the $ 3.00 barrier.

Summary of price action

• XRP exchanged a strip of $ 0.10 (2.9%) From $ 2,935 to $ 3.035 between September 9 at 3:00 a.m. and September 10 at 2:00 a.m.

• The token reached $ 3.035 during morning negotiations, but experienced immediate rejection nearly $ 3.02 of resistance.

• A sale of 2:00 p.m. dropped XRP from $ 3.018 to $ 2,956 over a volume of 165.67 million – almost triple of the daily average.

• Consolidated price at the end between $ 2.94 and $ 2.96, with moderate activity on average of 650,000 volumes per minute.

Technical analysis

• Resistance: $ 3.02 to $ 3.04 per level capped upwards, with several high volume refusals.

• Support: $ 2.94 area tested and held, suggesting accumulation by institutional players.

• Momentum: RSI shows an early bullish divergence, but the reserves of exchanges in top weigh on follow -up.

• Structure: A faulty rupture implies the consolidation of $ 2.94 to $ 3.00 unless the volume returns.

• Range: 3% of intra -day swings highlight institutional volatility.

What traders look at

• The fact that XRP can maintain ends above $ 2.95 to create a momentum for an $ 3.02 escape.

• EXCOATE OF CUSTOMES TO SIGNES OF 12 MONTH – Will entries convert into sustained sales pressure?

• The DEC FNB decisions, which could act as a structural catalyst if land approval.

• Decision to lower the rate of September 17 of the Fed, traders positioning themselves for its impact on the liquidity of the dollar.

• Whale entries – 340 m of chips accumulated in recent weeks – and if the purchase of compensations exchange distribution.