Dogecoin joined strongly during the session from September 9 to 10, recovering the range from $ 0.24 to $ 0.25 with a volume greater than 1.5 billion tokens. This decision comes as Rex-Osprey is preparing to start the first American ETF of Dogecoin on September 11 under the “Doje” ticker.

Technical merchants have reported an optimistic pennant rupture model, while the accumulation of large -scale whales added to the growing confidence that institutional demand accumulates around launch.

New context

• REX-OSPREY DOGE ETF should start to negotiate on September 11, which makes it the first negotiated American stock market fund following a same declared utility.

• Whale addresses accumulated around 280 million DOGE last week, indicating solid flows of institutional size.

• Technical analysts highlight an escape from pennants with upwards up from $ 0.28 to $ 0.30 if the level of $ 0.25 is maintained.

• Speculation of ETFs has motivated the enthusiasm of retail and social media, Doges have great tendency to prediction markets and derivative offices.

Summary of price action

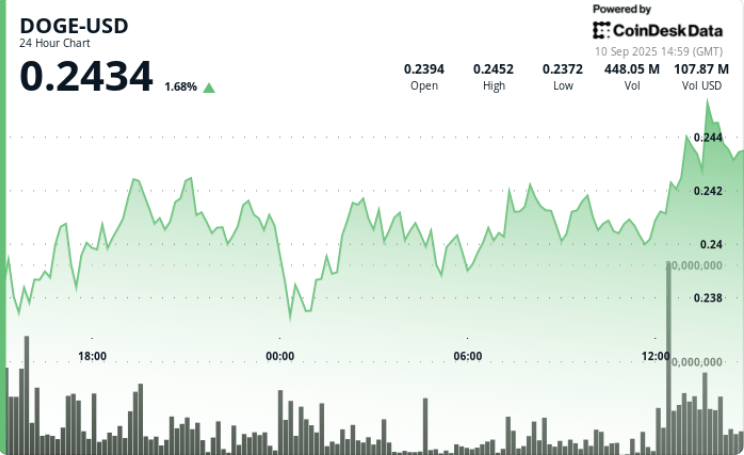

• DOGE advanced 4% during the session from September 9 from September 9 to September 12:00 p.m., from $ 0.236 to a peak of $ 0.245.

• Early decline saw DOGE from $ 0.247 to $ 0.236 at 2:00 p.m., supported by a massive volume of 1.55 billion which set a strong soil.

• Consolidated price from $ 0.238 to $ 0.242 during most of the day, which suggests a strategic accumulation.

• Doge’s last time Doge from $ 0.240 to $ 0.245, underpinned by 114.7 million volume at the top.

• The session ended at $ 0.244, just before the resistance, confirming the bullish momentum in the launch week of the ETF.

Technical analysis

• Support: $ 0.236 to $ 0.238 validated by repeated rebounds at high volume.

• Resistance: $ 0.245 to $ 0.247 remains the key ceiling; Rupture above could target $ 0.28.

• Volume: session summits of 1.55 billion and the end of the hour 114.7 m considerably exceeded the average of 24 hours of 334 m.

• Structure: Pennant breakout confirmed by higher stockings and accelerate volumes of the final hour.

• Indicators: RSI hovering in the mid -1960s suggested room for further before emerging excessive conditions.

What traders look at

• The fact that Doge can keep closes above $ 0.245 and has set up a thrust around $ 0.28.

• Launch of the ETF on September 11, which should be a structural liquidity event for Doge.

• Whale accumulation tendencies – Maintenance entries would validate institutional condemnation.

• The positioning of derivatives as the ETF media threw is built, with increased volatile of volatility around launch.

• Watest feeling of the cryptography market linked to the federal reserve policy decisions later in the month.