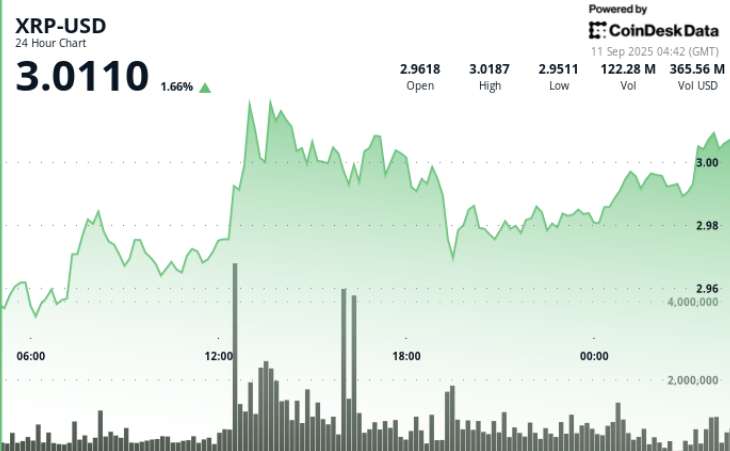

XRP pierced the psychological threshold of $ 3.00 in a heavy volume session which reported solid institutional flows.

The rally transported the token of $ 2.96 to $ 2.99 in 24 hours, with noon eruptions on volumes six times the daily average.

Despite a resistance confronted with almost $ 3.02, the market structure suggests an accumulation, the bulls defending the support of around $ 2.98 while the traders grant momentum for a push towards higher extension levels.

New context

• The Midi Rally of September 10 was powered by an explosion of volume of 116.7 m and 119.0 million units in the hours of 12: 00 to 13: 00, far exceeding the average of 24 hours of 48.3 m.

• Interests open to term climbed $ 7.94 billion, showing increased positioning of derivatives alongside the punctual activity.

• Analysts report a decreasing scenario of the triangle with targets measured in the $ 3.60 area if the momentum persists.

• Larger risk assets continue to follow the expectations of the federal reserve, the rate drop in rate supporting flows in cryptographic assets with high capitalization.

Summary of price action

• XRP went from $ 2.96 to $ 2.99 in September 9 9 p.m. September 8:00 p.m., a gain of 1% in a strip of $ 0.09.

• The escape occurred during the window of 12: 00 to 13: 00, when XRP increased from $ 2.98 to $ 3.02 over a volume of 119 million, fixing a short -term resistance zone.

• The last hour saw the sales pressure push the token at $ 2.98, before buyers restored support and closed almost $ 2.99.

• Volume peaks of more than 1.6 million per minute during the late session confirmed that institutional offers are involved at reduced levels.

Technical analysis

• Resistance: $ 3.02 remains the immediate ceiling after several refusals during peak trade.

• Support: Buyers defended $ 2.98 on $ 2.99 on several repetitions several times.

• Volume: the escape volumes at noon were six times the daily average, validating the movement.

• Structure: higher training of stockings suggest a sustained accumulation despite the resistance ceilings.

• Indicators: Techniques indicate a break -up scenario, with Fibonacci extensions projecting the upward potential to $ 3.60.

What traders look at

• The fact that XRP can keep closes above the $ 3.00 bar to turn the resistance to the support.

• Reaction to a resistance of $ 3.02 – A break could extend the targets to $ 3.20 to $ 3.60 in upcoming sessions.

• Under -term positioning and open interest at $ 7.9 billion, which could amplify volatility around key levels.

• Macro drivers of the political meeting of the federal reserve of September 17 and liquidity perspectives in dollars.