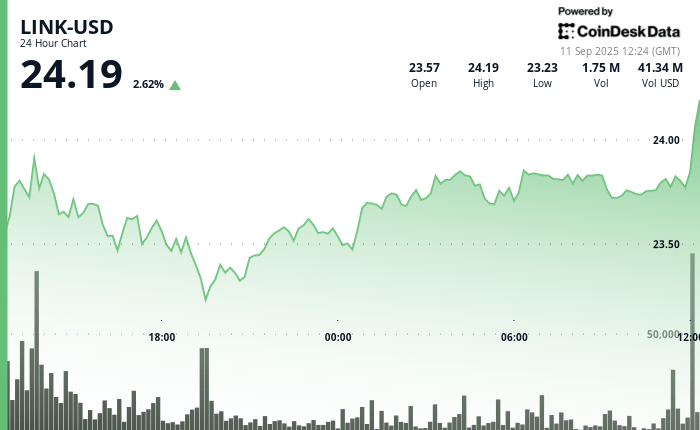

Native token link of the chain (LINK) Cross $ 24, advancing 2.5% Thursday while the supplier of Oracle revealed a joint project with Digift and UBS to automate token fund operations in Hong Kong.

The three companies obtained approval as part of the Hong Kong Cyberport asset pilot regime and the digital asset pilot subsidy to build an automated infrastructure for token financial products, according to a press release on Thursday.

Partners plan to rationalize how token funds are distributed, adjusted and managed throughout their life cycle. Today, these processes often involve manual documents that slow down transactions and increase the risk of error. By moving these steps to intelligent contracts, the project aims to reduce costs and normalize fund operations.

As part of the system, investors place orders for UBS tokenized products via the intelligent contracts of the regulated Digift distributor. Chainlink’s digital transfer agent then deals with transactions and records them in ONCHAIN, which in turn triggers the program or takeover on UBS token contracts.

In other recent news, ChainLink also presented its transverse interoperability protocol to the Aptos Blockchain, expanding business quality connectivity solutions for decentralized financial applications and business treasures management.

Technical analysis

- Chainlink’s link has demonstrated a strong technical recovery after its 20% since mid-August, said the Technical Analysis model of Coindesk Research.

- Support based on the volume established at $ 23.60 in the escape level, confirmed by supported purchase interest.

- The token has surpassed the wider benchmark in the Coindesk 20 cryptography market, which increased by 1.5% during the same period.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.