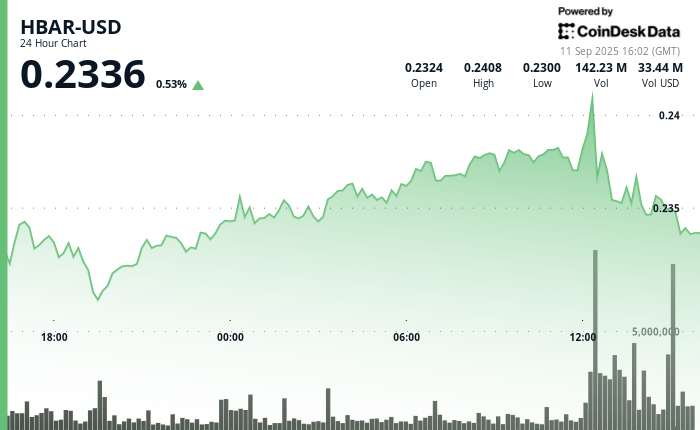

The Hedera Hbar token saw a volatile stretch of 11 p.m. between September 10 and 11, swinging in a narrow strip of 5% between $ 0.23 and $ 0.24. The token dropped at its level of support of $ 0.23 at the start of the session before bolishing on heavier trading volumes than usual. The daily volume was on average by 35.4 million, but the activity increased to 156.1 million by noon on September 11, while institutional money seemed to circulate, propelling Hbar to the $ 0.24 ceiling.

Despite the rally, Hbar had a hard time piercing resistance at $ 0.24, where high sales pressure emerged. Rejection at this technical level highlighted the importance of $ 0.23 as a company support and $ 0.24 as a critical obstacle for new gains. Analysts note that a fence greater than $ 0.24 could open the door to a gathering of 25% towards the objective of $ 0.25, but the non-compliance with the resistance to violation leaves the beach of token linked to the corridor from 0.21 to 0.23 $.

The increase in commercial activity has coincided with regulatory developments. On September 9, Grayscale filed with the Securities and Exchange American Commission (SECOND) To convert his Trust Hedera Hbar to the Stock Exchange Funds (ETF)Alongside similar deposits for Bitcoin Cash and Litecoin. The SEC set a deadline on November 12 to decide on the proposed list of the NASDAQ, which makes the next two months for the institutional adoption prospects of Hbar.

The FNB file has attracted the demand for traditional asset managers who are looking for a wider exposure to digital assets. With regulatory clarity on the horizon, the action of Hbar prices reflects an show between the bullish institutional interest and technical obstacles. Participants in the market will ensure if the SEC decision provides the Breakout Hbar catalyst must test higher levels.

Summary of technical indicators

- The negotiation range of $ 0.011 is equivalent to a spread of $ 5% of $ 0.23 to $ 0.24 from more than 23 hours.

- A solid support of $ 0.23 is based on a volume reversal of 37.8 million.

- The volume in small groups reaches 156.1 million during the recovery. Confirmed institutional flows.

- The key resistance of $ 0.24 triggers a reversal of massive volume. Obvious heavy sales pressure.

- Volatility of the final hour September 11, 13: 14-14: 13 Watch $ 0.0072 varies between $ 0.24.

- A clear reversal to a resistance of $ 0.24 on a volume peak of 2.28 million creates a rejection model.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.