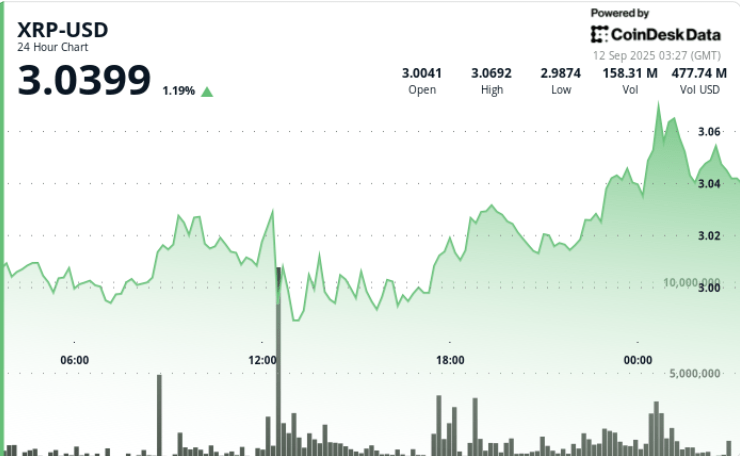

XRP broke out above September 11 with heavy institutional entries pushing the volume four times above the daily averages.

The token increased by almost 2% to close almost $ 3.05, defending support at $ 2.98 before testing resistance at around $ 3.07.

Analysts say that if the accumulation models remain strong, high exchange reserves and ETF speculation add volatility layers to the following directional movement.

New context

• Ripple has strengthened its partnership with the Spanish banking giant BBVA to provide digital custody solutions within the framework of EU Mica, strengthening institutional legitimacy.

• Larger Crypto markets followed macro-catalisseurs, including the expectations of world banks’ rate decisions and the change of debates on commercial policies.

• The open interest of term contracts on XRP has increased to $ 8.36 billion, reflecting leverage positioning before potential announcements linked to ETF.

• Whale wallets have accumulated 340 m of XRP token in recent weeks, while exchange stocks have reached a year, which raised questions of short -term distribution pressure.

Summary of price action

• XRP went from $ 2.98 to $ 3.05 at the September 11 negotiation window, marking a gain of 1.85% in a band of $ 0.10.

• The most aggressive purchases occurred during the 12 hour session, where the volume reached 243.37 m – more than 4x the daily average of 58.9 m – confirming solid institutional offers.

• The resistance formed nearly $ 3.07 after several attempts to fail at midnight, while the ceiling for profit advances greater than $ 3.05.

• The last hour saw a decline of $ 3.06 to $ 3.04 (-0.68%) As the distribution pressure increased, with 2.29 m units exchanged at 01:41 triggering a clear drop.

• Despite the late retirement, the price has closed in consolidation greater than $ 3.04, which suggests continuous accumulation at reduced levels.

Technical analysis

• Support anchored at $ 2.98, validated by disproportionate purchase volumes.

• The resistance focused between $ 3.05 and $ 3.07, where repeated refusals occurred.

• The tightening of the formation of triangles descending around the corridor from $ 3.00 to $ 3.07 points to an imminent rupture resolution.

• Pinks of last hour volume (2.29m at 01:41, 1.18m at 02:03) has shown a strong distribution followed by attempts to recover rapidly.

• RSI improvements on intrajournal graphics suggest that the purchase of the momentum is being built, although the exchange entries remain a headwind.

What traders look at

• The question of whether XRP can keep closes above $ 3.05 and challenge the resistance zone of $ 3.07 – an escape could open the way to $ 3.20 in the short term.

• The exchange reserves reach 12 -month summits, which traders consider as a possible sign of distribution pressure warning if the hooks of whale are stagnated.

• The impact of Ripple’s enlarged BBVA partnership under Mica, which can accelerate the adoption of the institutional guard and the stability of support prices.

• Positioning on the derivative markets: the call options are now more numerous than 3 to 1 with strikes which bring together about $ 3.00 to $ 3.50, reflecting an upward inclination before the September 12 expirations.

• Macro signals, in particular the rate decisions of central banks and liquidity conditions, which continue to dictate flows in cryptographic assets with large capitalization.