Historical data suggest that bitcoin probably put its bottom in September 2025, around $ 107,000 the first of the month.

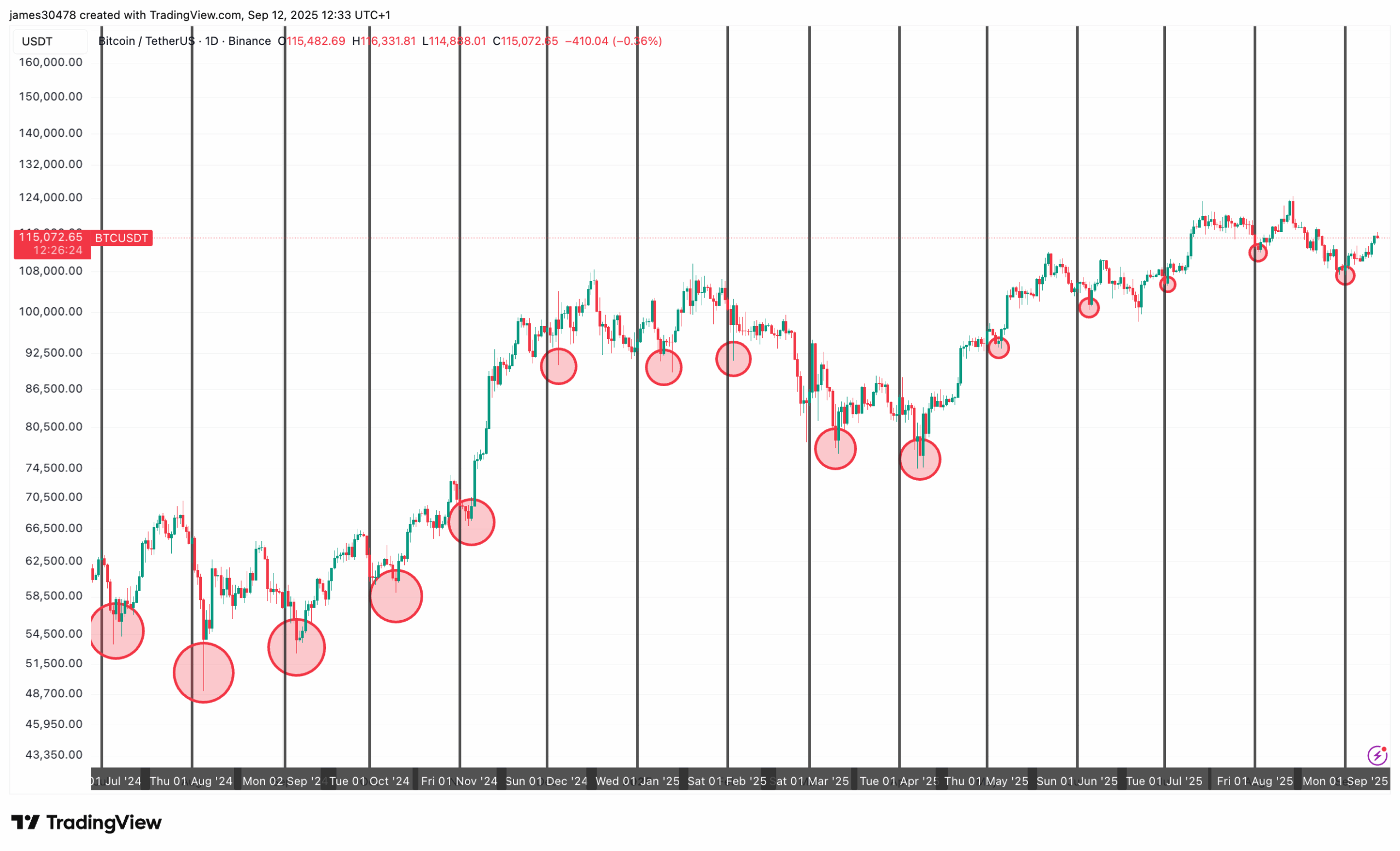

Looking in July 2024, a coherent scheme emerged where Bitcoin tends to form a background for the month in the first 10 days of each month.

The notable exceptions were in February, June and August 2025, when the stockings came later in the month, but even then, the market experienced a correction in the first 10 days before resuming its broader trend.

Speculatively, the reason why Bitcoin often puts in its low in the first 10 days of the month could be linked to the rebalancing of the institutional portfolio or at the time of key macroeconomic events which tend to regroup at the beginning of the month.

“It should be noted that several term markets and options expire on the last day of the month or the first day of the next one, this can lead to short -term volatility and subsequent lull in commercial activity as traders, that is, fully rolling or repositioning trades,” said Oliver Knight, Deputy Chief Editor, data and tokens.

Of course, past performance is not a guarantee of future results, but as the fourth quarter is approaching, it should be noted that this quarter has always been the strongest of Bitcoin, offering an average yield of 85%. October in particular has been particularly favorable, with only two months lost since 2013.