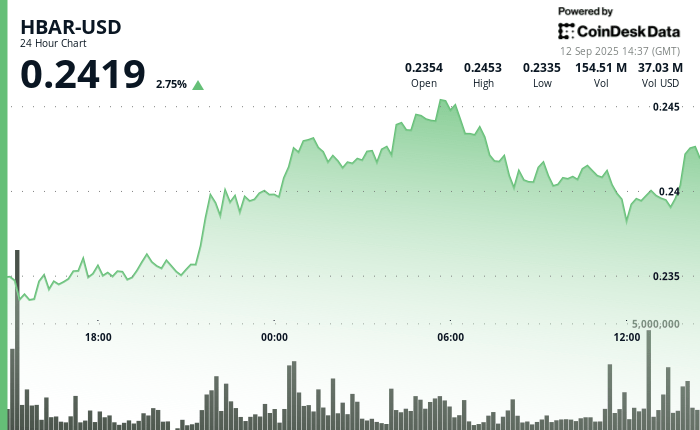

The native token of Hedera Hbar displayed modest gains during the negotiation window from September 11 to 12, going from $ 0.237 to $ 0.245 before ending at $ 0.240. This decision reflected an increase in institutional participation, with market activity closely linked to new developments around potential products negotiated in exchange.

Momentum of companies built after gray level investments revealed plans for a potential Hbar trust and the deposit of trust and compensation Corporation (DTCC) Adding an ETF Hbar Canary file to its regulatory database. The list, under the proposed Ticker HBR, has accompanied similar submissions for Solana and XRP, highlighting the growth of the appetite of Wall Street for digital assets beyond Bitcoin.

The merchants reacted greatly to the news. Technical resistance at $ 0.245 sparked the profits, while $ 0.240 has become a key institutional level of institutional support, reinforced by volume peaks at the end of the session which exceeded 17 million tokens. Analysts indicate that speculation could set up a psychological threshold test of $ 0.25 if the momentum continues.

However, industry observers warn that the DTCC inclusions represent only the preliminary stages, and not the approval of the dry. Regulators remain concentrated on the fight against the risks of market manipulation and investor protection standards for non -bitcoin crypto assets, leaving the calendar for any uncertain Hbar ETF. For the moment, the deposits have firmly placed Hedera on the Wall Street radar, attracting institutional attention, even in the middle of the regulatory fog.

Market data reveal institutional trading models

- The intraday trading established a range of $ 0.012 representing a volatility of 4.24% between the top of the session of $ 0.2456 and a minimum of $ 0.2335.

- The up primary momentum occurred during the trading window of 21: 00-05: 00 while Hbar increased by $ 0.235 at peak levels close to $ 0.245.

- The volume activity reached an average of 54.7 million during the main periods of break, exceeding the average of 50.1 million 24 hours and indicating institutional participation.

- The price level of $ 0.240 has demonstrated solid institutional support with a defensive exchange at high volume throughout the session.

- The sale pressure has intensified almost $ 0.245 over a high volume, which suggests a profit -based profit by institutional holders.

- An increase in the volume at the end of the session of 17.08 million at 11:32 am triggered a systematic consolidation of sale and prices around the levels of support.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.