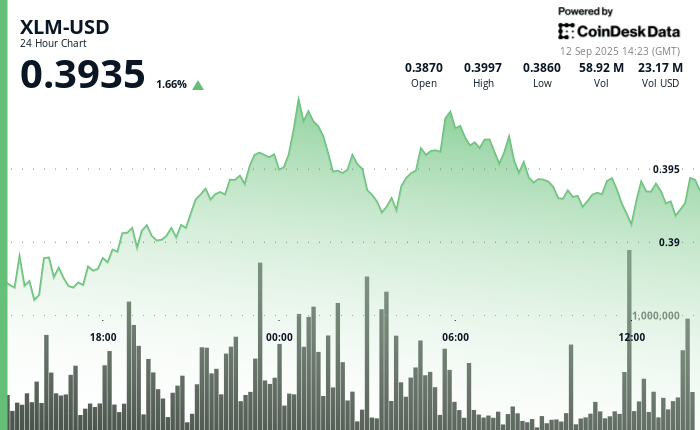

The Stellar XLM has traveled a 24 -hour volatile negotiation session from September 11 to September 12, oscillating between $ 0.384 and $ 0,400 before closing nearly $ 0.393. The token has experienced an early force, progressing towards session peaks around $ 0,400, but the sale of pressure in the last hours has pushed prices to support levels at $ 0.392. Market analysts note that this distribution activity at the end of the session underlines the corrective movement which weighed on XLM despite its otherwise resilient performance.

The withdrawal coincided with the increase in competition in the payment sector. The new entrant Remitix was launched with a reference incentive of 15% USDT and obtained $ 25.2 million in funding, weaken challenges to holders like XRP of Ripple and XLM of Stellar. The aggressive marketing strategy highlights the intensification of rivalry in the arena of cross -border payments, a sector for a long time dominated by these two tokens.

At the same time, some technical strategists see a long -term increase for XLM. Elliott Wave projections suggest that the token could stage a rally of 400% to $ 1.96, a decision that would place Stellar’s market capitalization in the range of 60 to 71 billion dollars. This perspective depends on broader adoption trends and the resilience of the Stellar ecosystem as competition is accelerating.

Adding to Market intrigue, a digital active researcher suggested that Ripple and Stellar could collaborate on a unified global financial infrastructure which exploits cryptographic protocols with zero knowledge. Although not confirmed, such a decision would represent an important step in the alignment of blockchain networks to improve security, confidentiality and interoperability through global finance.

Technical measures assessment

- XLM has established a full negotiation range of $ 0.02 representing 4% volatility covering $ 0.38 to $ 0.40.

- The bullish burst supported throughout the opening of 17 hours with an progress of 3% supported by increased participation in volume.

- The session peak of $ 0.40 reached at midnight on September 12 before meeting technical resistance.

- Foundation support established a threshold of approximately $ 0.39 containing the decline for seven hours.

- The last 60 minutes have shown down pressure with a drop from $ 0.39 to $ 0.39 confirming the wider corrective trend.

- Intra -day summit from $ 0.39 to 11:24 before the net overthrow at $ 0.39 of resistance threshold.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.