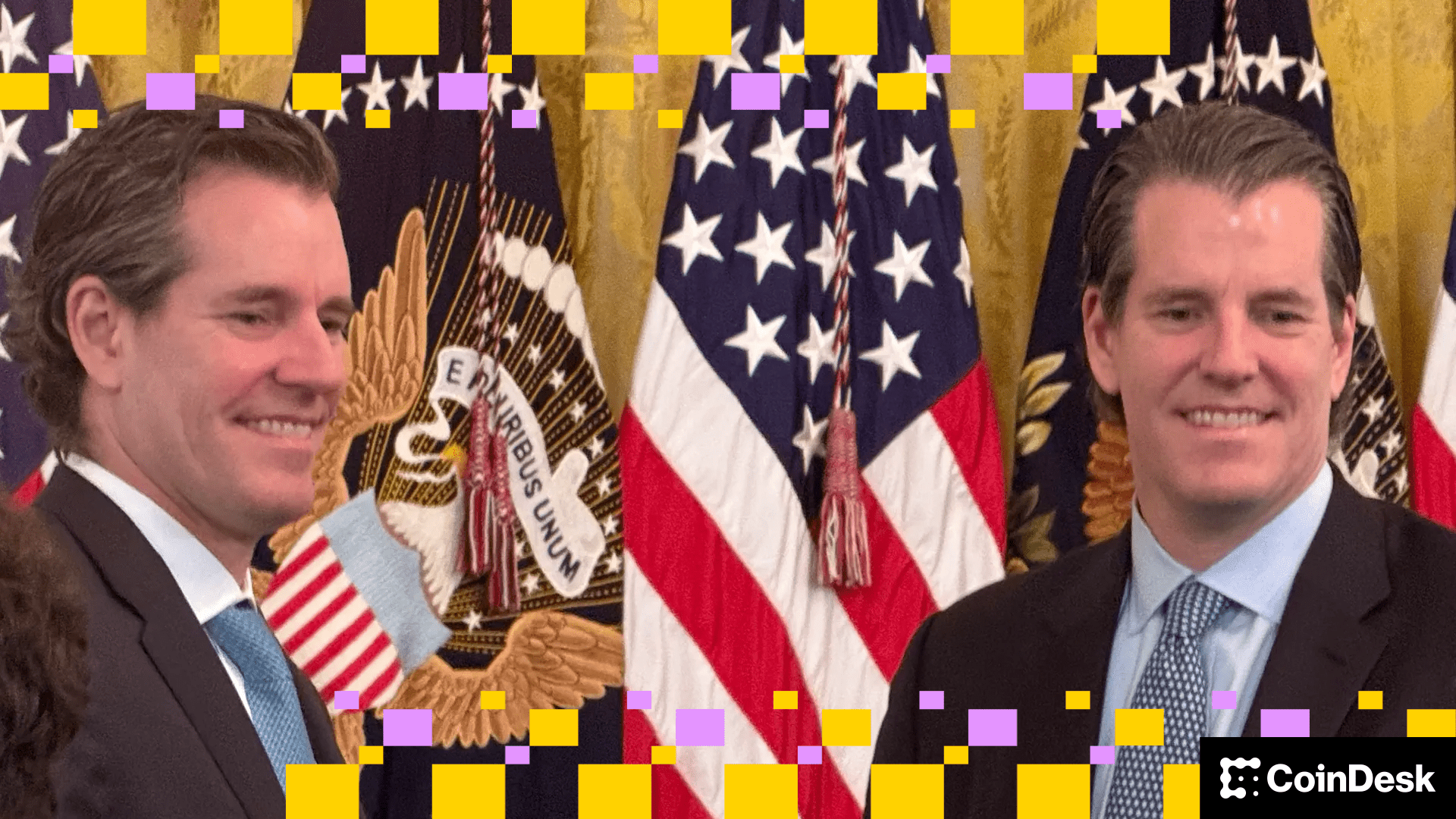

Gemini, the exchange crypto supported by Tyler and Cameron Winklevoss, estimated its initial public offer at $ 28 per share, assessing the company at around $ 3.3 billion.

The company sold 15.2 million shares, raising $ 425 million, she said in a press release on Thursday. The IPO was 20 times a stay, according to a Reuters report on Thursday.

The actions will begin to negotiate on the Nasdaq Global Select Market on Friday in the symbol of Ticker Gemi.

Exchange is the last indigenous enterprise in Crypto to make public. Exchange Rival Haussier (BLSH)Coindesk owner sold shares at $ 37 each last month, above the expected range from $ 32 to 33.

Gemini declared Tuesday in a deposit that the giant of Tradfi Nasdaq (Ndaq)had agreed to buy $ 50 million from its ordinary class A shares in a private investment at a price equal to the IPO price.

The main subscribers on the IPO of Gemini was Goldman Sachs (GS)Citigroup (C)Morgan Stanley (Ms) and cantor.

Gemini increased the price of the IPO price to $ 24 to $ 26, from $ 17 to $ 19, in a S1 deposit updated earlier in the week.

Find out more: Crypto Exchange Gemini increases the IPO price range at $ 24 to $ 26 per share