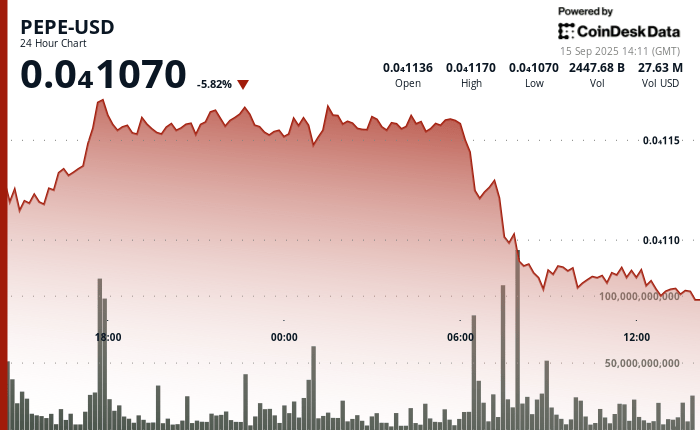

The cryptocurrency inspired by the same Pepe lost almost 6% of its value during the last 24-hour period, going to a hollow of $ 0.0000107, even if significant investors accumulate.

Trading volumes against cryptocurrency increased in billions of tokens in the middle of the decline, because the token kept finding support in the middle of intense sales pressure. The drop occurred in the middle of a wider draw on the cryptography market, where the Coindesk 20 wider (CD20) The index lost 1.8% of its value.

Same was particularly affected by the sale. The Coindesk samecoin index dropped by almost 5% in the last 24 hours, while Bitcoin experienced a drop of 0.8%.

The decline occurs only a few days after speculation in the Altcoin season has increased among cryptocurrency circles on the expected interest rate of the federal reserve later this week, which should be a boon for risk assets.

Nansen’s data show that in last week, the 100 best non -exchange addresses holding Pepe on the Ethereum network saw their assets increase by 1.38% to 307.33 billions of tokens, while exchange portfolios had a 1.45% drop in assets to 254.4 tokens.

Preview of technical analysis

The action of PEPE prices highlighted a retirement market, according to the Technical Analysis Data model for Coindesk Research. The token went from 0.00000011484 to $ 0.000010782, the sellers dominating the graphic.

The price culminated at 0.000000111732 during a resistance test, but the volume inflated to 5.5 billions of tokens at this level, before the market is ultimately lower.

Support showed signs of buckling during the next phase, with the brushing of the token against 0.00000010746. Commercial activity has once again intensified, hitting 7.7 billions of tokens and strengthening the bearish feeling.

The price of the cryptocurrency made a whip in an intra-day fork of 9%, a sign that the merchants remain uncertain if the support levels will hold.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.