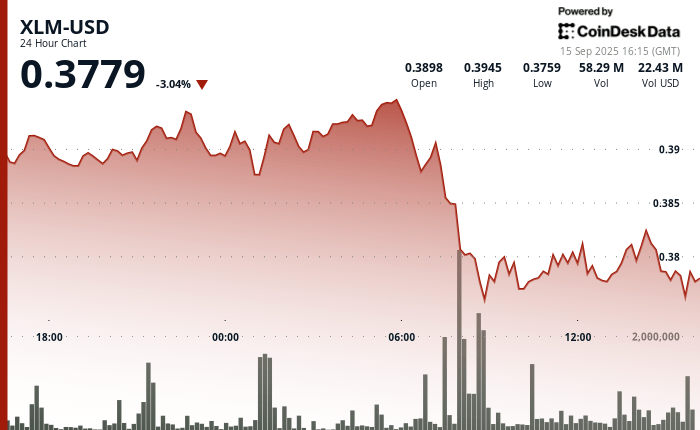

Stellar’s XLM token has endured net fluctuations in the last 24 hours, plumping 3% while the institutional sales pressure dominated the command books. The asset went from $ 0.39 to $ 0.38 between September 14 at 3:00 p.m. and September 15 at 2:00 p.m., with negotiation volumes peaking at 101.32 million, which trips its average of 24 hours. The heaviest liquidation struck during the morning hours of September 15, when XLM went from $ 0.395 to $ 0.376 in two hours, establishing $ 0.395 as a firm resistance while provisional support formed almost $ 0.375.

Despite the wider downward trend, intraday action has highlighted moments of resilience. From 1:15 p.m. to 2:14 p.m. on September 15, XLM organized a brief recovery, going from $ 0.378 to a session summit of $ 0.383 before closing the time to $ 0.380. The volume of negotiation jumped above 10 million units during this window, with 3.45 million hands changes in a single minute while the Bulls were trying to exceed resistance. Although the sellers have launched, the consolidation area between $ 0.380 to $ 0.381 now represents a potential support base.

Market dynamics suggest that distribution models in accordance with institutional profits. Persistent general supply costs have strengthened the resistance to $ 0.395, where repeated rally attempts failed, while the emergence of support close to $ 0.375 reflects opportunistic purchases during liquidation waves. For merchants, the band from $ 0.375 to $ 0.395 has become the key battlefield that will define short -term management.

Technical indicators

- XLM fell 3% from $ 0.39 to $ 0.38 in the previous 24 hours from September 14 3:00 p.m. to September 15.

- The volume of exchanges culminated at 101.32 million in 8:00 am, near the triple of the average 24 hours a day at 24.47 million.

- Strong resistance established a level of about $ 0.395 during the morning sale.

- The key support emerged almost $ 0.375 when the purchase of interest was materialized.

- Price range of $ 0.019 representing a volatility of 5% between the peak and the hollow.

- Recovery attempts reached $ 0.383 per 1:00 p.m. before undergoing sales pressure.

- The consolidation model was formed between $ 0.380 and $ 0.381 per area suggesting a new level of support.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.