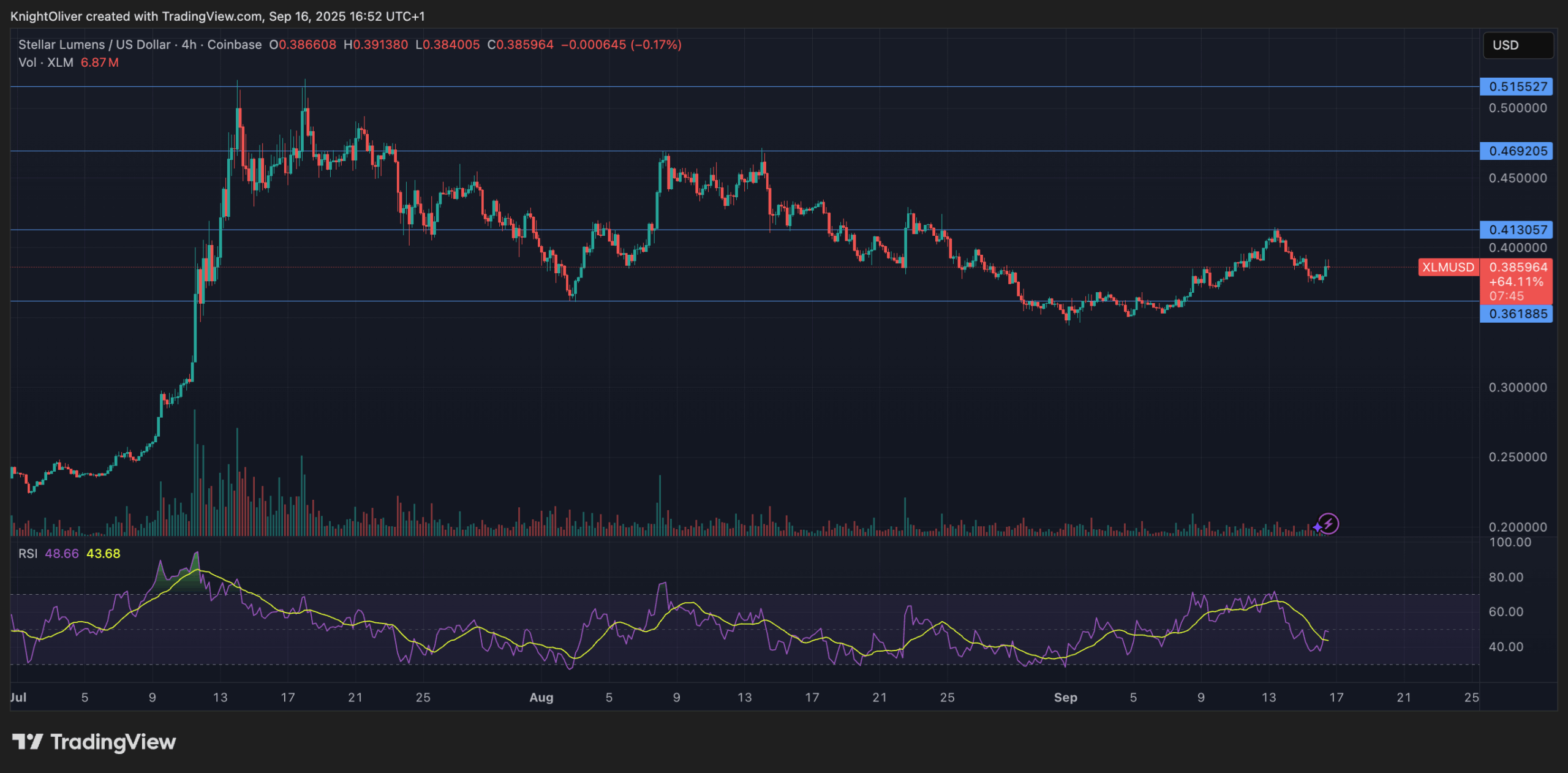

Stellar’s XLM token has experienced high volatility in the last 23 hours, swinging between $ 0.38 and $ 0.39 in a tight but active negotiation range. The most explosive movement of the token intervened between 08: 00 and 09: 00 UTC, when XLM went from $ 0.38 to $ 0.39 over a growing volume of 70 million, more than the triple of its average 24 hours a day.

The exchange of dynamics was carried out during the following hour, the volume remaining high above 60 million before the consolidated price near the upper band of the range.

The morning rally was fed by a mixture of technical activity and strengthening fundamental principles. In particular, a recent DTCC patent deposit referred to both XRP and XLM as compatible networks for liquidity tokenization within systems that manage almost $ 4 of quadrillion titles per year.

Meanwhile, the Stellar Development Foundation said that the main payment and asset management companies are preparing to be launched on the network in the coming weeks, a development coinciding with an increase of nine times of the total value of Stellar locked in the past year.

But the bullish momentum quickly evaporated during the last session. Between 1:15 p.m. and 2:14 p.m. UTC, XLM slipped by $ 0.39, erasing morning winnings.

The strongest sale struck around 13: 45–13: 47, when the token dropped over a heavy volume greater than 3.6 million. The activity has slowed down to zero in the last two minutes of negotiation, suggesting a step back institutional and potential short -term consolidation.

The whip highlights the vulnerability of cryptography to the feeling of rapid gap, even if institutional interest increases.

The morning escape of XLM underlined the enthusiasm around the expansion of Stellar’s expansion of a critical financial market infrastructure player. However, intra -day reversal has strengthened the speed with which optimism can give way to profits, which leaves prudent traders in a short -term direction.

Technical indicators show mixed signals

- The volume peak at 70.02 million during 08: 00-09: 00 strengthens strong resistance to $ 0.39.

- A heavy volume supported from 60.17 million to 09: 00-10: 00 confirms the bullish momentum.

- The consolidation of about $ 0.39 suggests that this area becomes a new support after a break.

- The last hour sales pressure on 3.6 million volumes establishes a new support area around $ 0.39.

- The zero negotiation volume in the last two minutes indicates institutional withdrawal.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.