Ethereum is in the middle of a paradox. Even if Ether reached record heights at the end of August, a decentralized financial activity (DEFI) on layer 1 of Ethereum (L1) seems silent compared to its peak at the end of 2021. The costs collected on Mainnet in August were only $ 44 million, a drop of 44% compared to the previous month.

Meanwhile, layer 2 networks (L2) like Arbitrum and Base are booming, with 20 billion dollars and $ 15 billion of total value locked (TVL) respectively.

Does this divergence raises a crucial question: does L2S cannibalize the Defi d’Ethereum activity, or does the ecosystem evolve in a multilayer financial architecture?

AJ Warner, the director of Offchain Labs strategy, the developer firm behind layer 2 arbitrum, maintains that the metrics are more nuanced than layer 2 of layer 2 on layer 1.

In an interview with Coindesk, Warner said that focusing only on TVL is missing the point, and that Ethereum is working more and more like the “global colony” of crypto, a base for the emission and the institutional activity of great value. Products like the tokenized funds of Franklin Templeton or the Buidl products of Blackrock are launching directly on Ethereum L1 – an activity which is not entirely captured in the metrics DEFI but underlines the role of Ethereum as a rocky substratum of cryptographic finance.

Ethereum as a layer 1 blockchain is the secure but relatively slow and expensive basic network. The layers-2 are on the scale of the networks built above it, designed to manage transactions faster and to a fraction of the cost before finally returning to Ethereum for safety. This is why they have become so attractive for merchants and manufacturers. Metrics like TVL, the quantity of crypto deposited in the DEFI protocols, highlight this change, because the activity is moved to L2 where lower costs and faster confirmations make the daily challenge much more practical.

Warner compares the place of Ethereum in the ecosystem to a transfer of wire in traditional finance: confidence, secure and used for a large -scale settlement. Daily transactions, however, migrate to L2S – Venos and Crypto Paypals.

“Ethereum was never going to be a monolithic blockchain with all the activity that is happening,” Warner told Coindesk. Instead, it is supposed to anchor security while allowing Rollups to execute faster, cheaper and more diverse applications.

Direction 2, which has exploded in recent years, because they have been considered a faster and cheaper alternative to Ethereum, allow whole challenge categories that do not work as well on maintenance. Trading strategies at rapid pace, such as arbitration of price differences between exchanges or management of perpetual term contracts, do not work well on the slightly slow blocks of Ethereum. But on Arbitrum, where transactions finalize in less than a second, these same strategies become possible, explained Warner. This is obvious, because Ethereum had less than 50 million transactions in the last month, compared to the 328 million basic transactions and the 77 million arbitrum transactions, according to L2Beat.

The manufacturers also consider L2 as an ideal test field. Alice Hou, research analyst at Messari, underlined innovations such as Uniswap V4 hooks, customizable features that can be a lot at lower cost on L2 before passing the dominant current. For developers, faster confirmations and lower costs are more than convenience: they widen what is possible.

“The L2 provides a natural playground to test these types of innovations, and once a hook has obtained popularity in small groups, it could attract new types of users who engage with Defi in a way that was not possible on L1,” said Hou.

But change is not just a question of technology. Liquidity providers respond to incentives. Hou said that the data show that smaller liquidity suppliers are preferring L2 more and more to yield incentives and the yields of the lower sliding amplifications. The larger liquidity suppliers, however, always come together on Ethereum, prioritizing the safety and the depth of liquidity on larger yields.

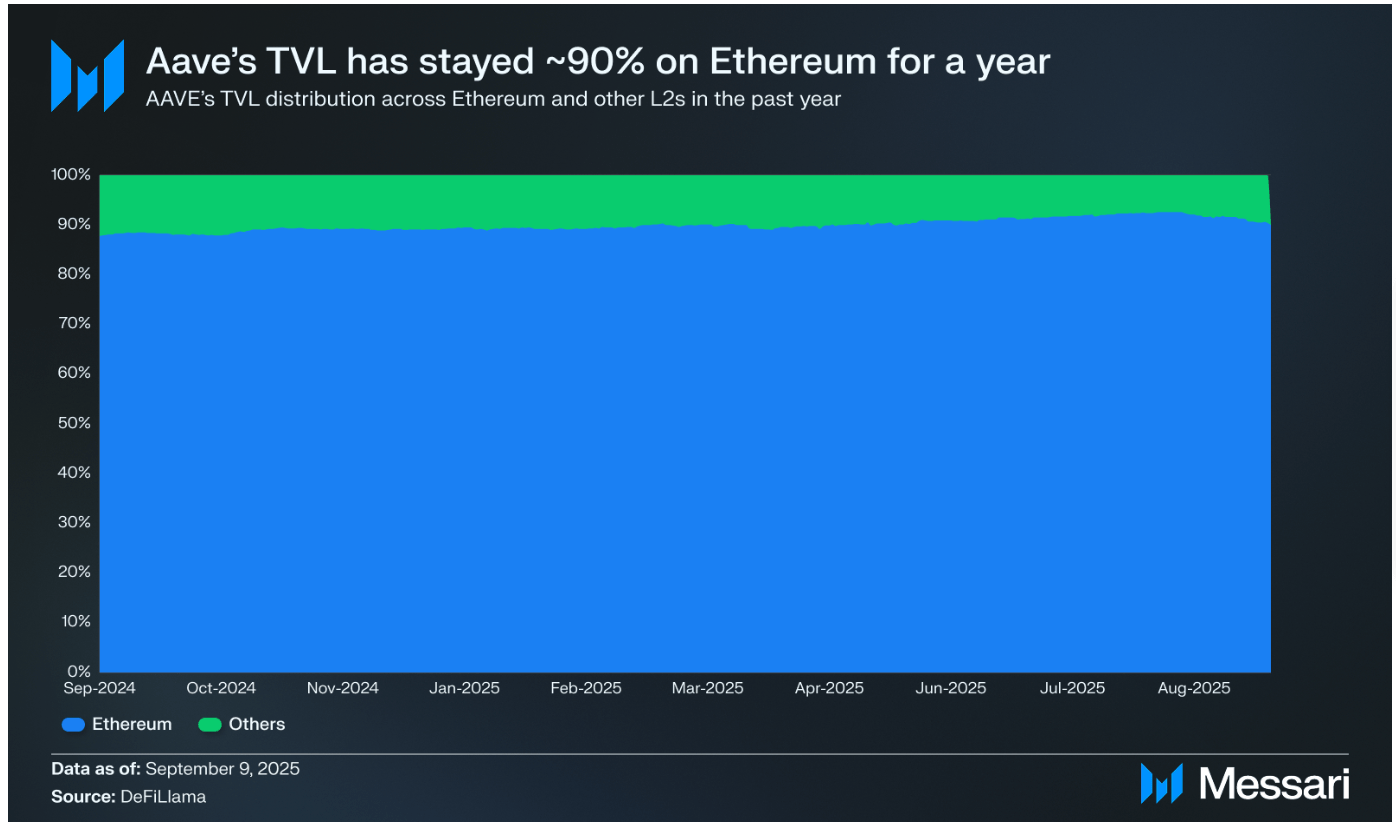

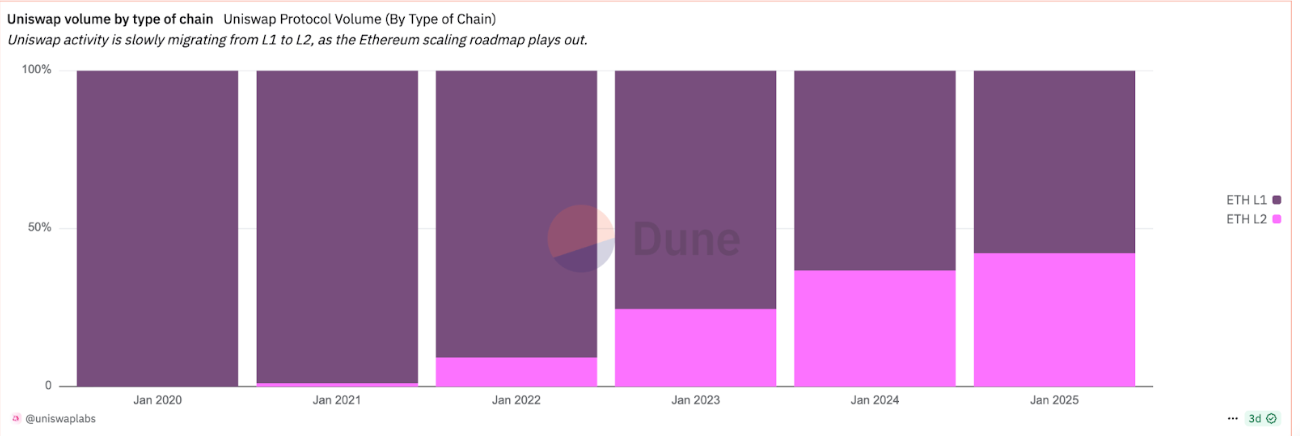

Interestingly, while the L2 captures more activity, the flagship protocols defi like Aave and Uniswap are always based strongly on the Mainnet. Aave has always kept around 90% of its TV on Ethereum. With UNISWAP, however, there was an incremental change to L2 activity.

Another factor accelerating the adoption of L2 is the user experience. Fiat bridges, bridges and ramps are increasingly directing new arrivals directly to L2S, Hou said. In the end, the data suggest that the L1 debate against L2 is not a zero summit.

In September 2025, around a third of L2 TVL is still sanded with Ethereum, another third party is natively struck and the rest passed by external bridges.

“This mixture shows that even if Ethereum remains a key source of liquidity, the L2 also develop their own native ecosystems and attract transversal assets,” said Hou.

Ethereum, as a base layer, seems to cement itself as the engine of secure compaction for global finance, while rollers like arbitrum and base emerge as execution layers for quick, inexpensive and creative DEFI applications.

“Most of the payments I take use something like Zelle or Paypal … But when I bought my house, I used a wire. It’s somewhat parallel to what is happening between Ethereum Layer One and the two layers,” said Warner de Offchain Labs.

Read more: Ethereum DEFI is late, even if the price for record summits