Bullish (BLSH), the parent company of Coindesk, has obtained a coveted ILB applied from the New York State Financial Services Department (NYDFS), a key regulatory approval that will allow the institutional digital assets to offer trading and guard services in New York on Wednesday in a press release.

Bitlidense, also known as the commercial activity license in virtual money, is considered one of the cryptography approvals at the most rigorous states in the United States

With him, the American Bullish entity, Bulsh US Operations LLC, can now contact institutional customers and advanced merchants of the country’s financial capital.

“New York is widely recognized as being at the forefront of virtual currency regulation,” said Tom Farley, CEO of Bullish, in the press release.

“The reception of our Bit Applicant Bit Transmission license and the transmission of money from the New York Department of Financial Services is a testimony to the bull’s commitment to regulatory compliance and our dedication to the construction of an infrastructure of digital assets of institutional quality in the main global markets,” he added.

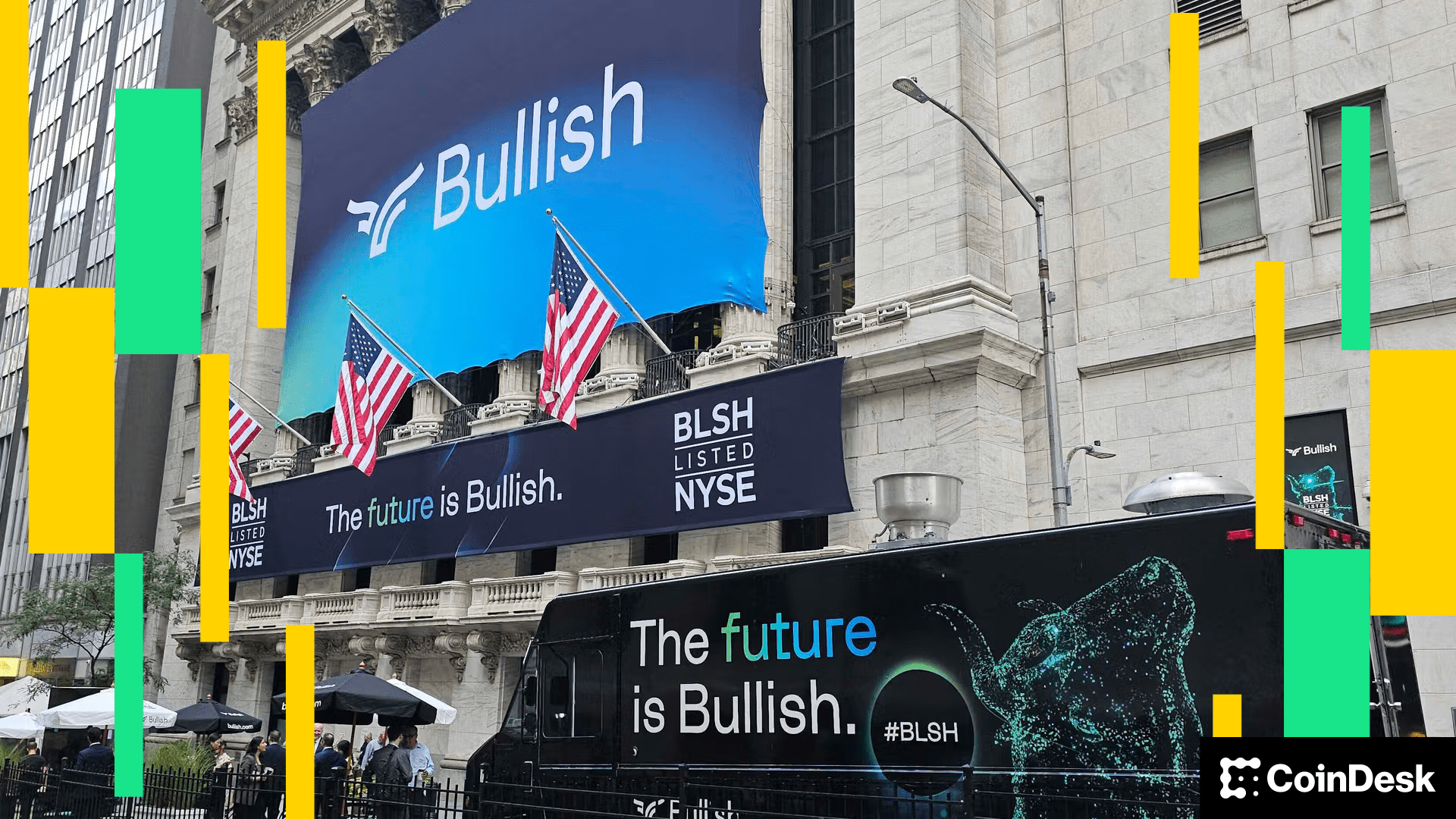

The license victory follows the successful initial public offer of the company in August. He marks the second exchange of Crypto, after Coinbase (Coin), to become a public in the United States

Bullish is also one of several cryptocurrency companies that have recently become public as part of the regulatory approach more suited to the assets of the Trump administration. Stablecoin Circle (CRCL) and Exchange Gemini (GEMI) also recently recently iPo’d.

Chris Tyrer, president of the Bulle exchange, described the approval of “an important regulatory stage” and said that it strengthens the credibility of the company to the institutions. “We believe that clear regulations stimulate responsible market development and institutional commitment,” Tyrer said in the press release.

Key catalyst

The milestone is added to the growing list of Bullish regulatory references.

The exchange is now regulated in the United States, Germany, Hong Kong and Gibraltar, and is positioned as a place designed for institutional quality liquidity, combining a central limit order book with automated market manufacturing.

Bitlidense erases the path for the crypto platform to develop in the United States, which Wall Street analysts have noted as a key catalyst for stock.

The Investment Bank Canaccord said that with bullish licenses in Europe and Asia, securing an applied bit would be open access to American institutional customers.

Meanwhile, the Bernstein broker said that the bruises could compete with competitors such as Coinbase if the platform successfully launched in the United States in 2026. “We expect Bulshish capture ~ 8% of market share in the volumes of American institutional crypto by 2027th, while the global market share remains at ~ 7%” Bernstein.

The KBW investment bank also said that the expansion of the United States in the short term was a growth catalyst for the bullish, and the company’s differentiated technological battery, competitive costs and profound liquidity positioning it to gain market share.

Find out more: Bullish obtains a new KBW $ 55 course target with an American entry considered a key catalyst