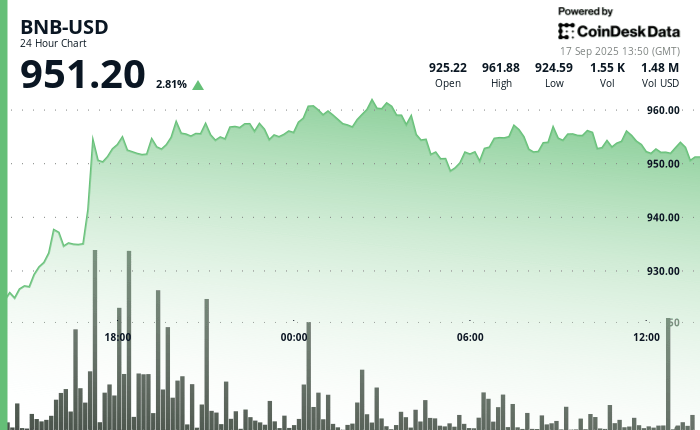

The BNB price has increased by almost 3% in the last 24 hours after Bloomberg indicated that Binance was heading for a potential agreement that would end the AA compliance requirements of the Stock Exchange Regulation in 2023 with the United States Ministry of Justice.

BNB, which provides reduced price negotiation costs on the stock market, recently negotiated nearly $ 950 after failing to make it pass decisively on a rally that started after the report. The instructor appointed by the court was appointed as part of the 4.3 billion dollars of Binance on violations of anti-money transmission.

This decision would follow a growing trend inside the doj, which has already published at least three other companies, including a branch of the British lender Natwest Group and the Naval manufacturer Austin, of similar surveillance after having agreed to improve declaration requirements.

If it is finalized, the agreement would probably require Binance to adopt more strict internal report systems. The Doj has not made a final decision, according to Bloomberg, and the own instructor of the Treasury Department on Binance would remain in place for the moment, adds the report.

The price of BNB increased up to $ 963 during today’s negotiation session, its highest level for months, before setting up. Trading volumes have also increased.

The increase enabled BNB to surpass the wider cryptography market, which traveled from the water before the interest rate decision of the Federal Reserve due Wednesday later. The Coindesk 20 index (CD20) is up 0.8% in the last 24 hours.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.