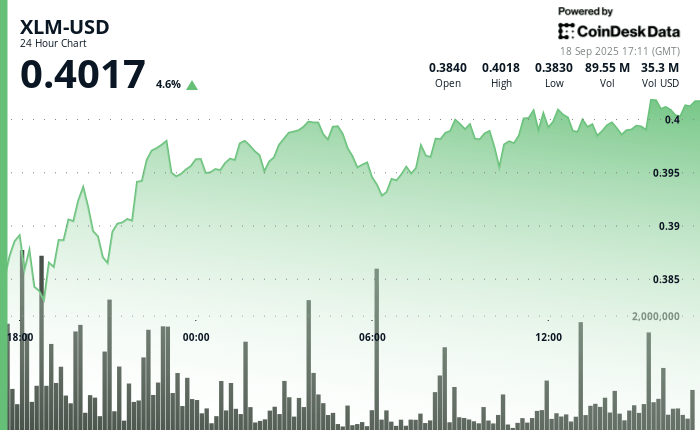

The XLM of Stellar demonstrated a notable resilience during the 24/24/24 session from 5:00 to September 16:00 (UTC)merchant in a corridor of $ 0.02 between $ 0.38 and $ 0.40.

The assets showed net recovery after early weakness, with strong advances based on volume at $ 0.39 around 7:00 p.m. and again at $ 0.40 around 3:00 p.m.

Transaction volumes of 40.04 million and 33.80 million at these levels have both exceeded the average of 30.47 million 24 hours, highlighting the business interest of the company. The repeated tests of the resistance zone of $ 0.40 highlighted the threshold as a key battlefield, while the support is consolidated just below, pointing to a regular accumulation.

The last hour of negotiation has proven to be particularly strong, XLM going from $ 0.40 to a session summit from $ 0.40 to 15:36, supported by an increase in volume to 7.50 million, 24 times 24 times the typical hourly level. This disproportionate activity has strengthened a rupture movement, buyers regularly defending the level of $ 0.40. Market behavior suggested sustained institutional participation, laying the basis for an extension of the 24 -hour trend.

During the period, XLM appreciated almost 4%, from $ 0.38 to $ 0.40. Commercial data has underlined a constant institutional positioning, with high volume movements suggesting longer -term accumulation strategies rather than short -term speculative flows. The ability to maintain higher support levels while repeatedly probing the resistance areas has further confirmed the bullish momentum.

Technical indicators report continuous strength

- Trading corridor of $ 0.02 constituting a differential of 5% between $ 0.38 and $ 0.40 in ceiling during the 24 -hour session.

- Advanced reinforced in volume at $ 0.39 and $ 0.40 with 40.04 million and 33.80 million volumes exceeding the basic line of 30.47 m.

- Primary resistance in a territory of $ 0.40 to $ 0.40 with repeated tests demonstrating institutional commitment.

- Support establishment of approximately $ 0.40 to $ 0.40 indicating accumulation during market declines.

- Remarkable acceleration of 60 minutes of volume of 7.50 m constituting 24 times standard standard time reference.

- Reliable support greater than $ 0.40 Seurmold according to the primary bass configuration.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.