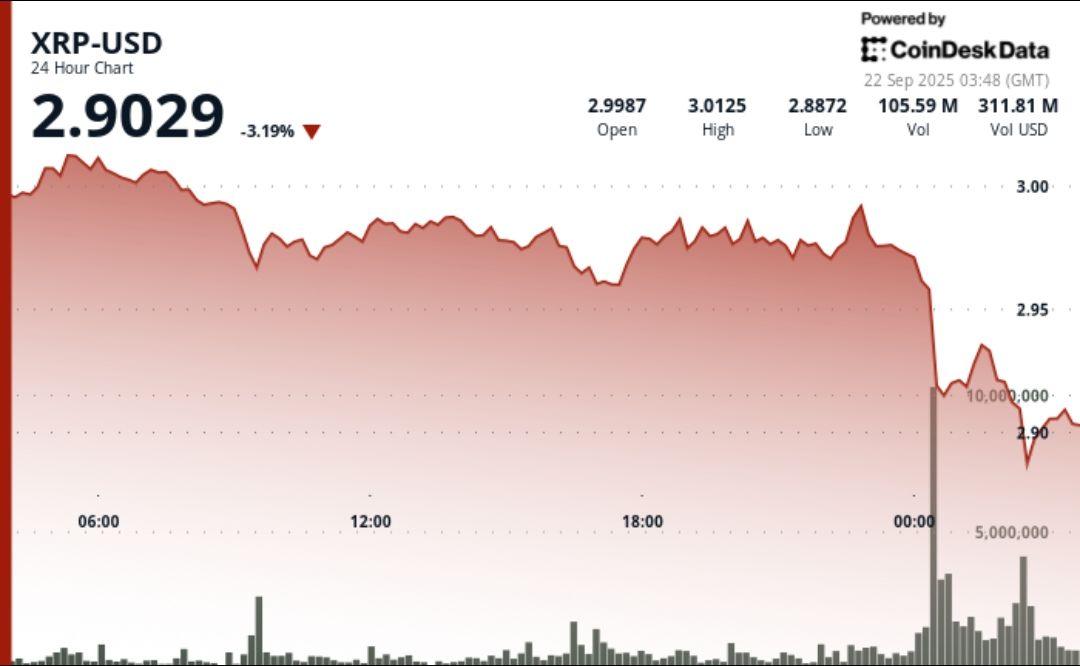

XRP endured a volatile session of 24 hours from September 21 at 3:00 a.m. to September 22 at 2:00 a.m., swinging 3.46% between a summit of $ 3.014 and $ 2.910.

The sale coincided with the beginnings of the first ETF XRP listed in the United States, which established records with $ 37.7 million in opening volume, but institutional profit has submerged the Haussier catalyst.

New context

• The first ETF XRP classified in the United States was launched on September 21, generating $ 37.7 million in day volume – the largest ETF debut of 2025.

• The relaxation of the federal reserve policy remains at home, the markets tariffing the rate reductions of September which generally support digital assets.

• Analysts warn against structural consolidation despite the ETF momentum, the resistance persisting nearly $ 3.00.

Summary of price action

• XRP dropped by 3.46% during the period 24 hours a day, collapsing from $ 3.01 to $ 2.91 before ending at $ 2.92.

• The midnight accident brought the price from $ 2,973 to $ 2,910, by releasing 2,61.22 million volumes – daily medium quadrules.

• Liquidations totaled $ 7.93 million during the rout, with 90% reaching long positions.

• The last 60 minutes saw the XRP rebound from $ 2.92 to $ 2.94, only to return to $ 2.92, creating a resistance cluster at $ 2.93 to $ 2.94.

Technical analysis

• negotiation plux: SPAN of $ 0.104 representing a volatility of 3.46% between $ 3.014 and $ 2,910 low.

• Resistance established at $ 2.98 at $ 3.00 after high volume rejection.

• Support area formed at $ 2.91 at $ 2.92, tested several times after the accident.

• Consolidation emerged almost $ 2.92 in the last hour because XRP failed to maintain $ 2.93.

• The volume explosion of 261 m confirms the vague institutional sale overlooking night flows.

What traders look at

• Can XRP Reclaim and Sustain close above $ 3.00, or resistance to $ 2.98 to $ 3.00 an upward ceiling?

• How the secondary flows of the new ETF affect liquidity, given the record participation of the day.

• Decision of the September rate of the Fed and if Dovish ‘policy is stretching cryptography entries.

• Exchange of reserves at 12 months, signaling the potential offer overhang despite the institutional interest.