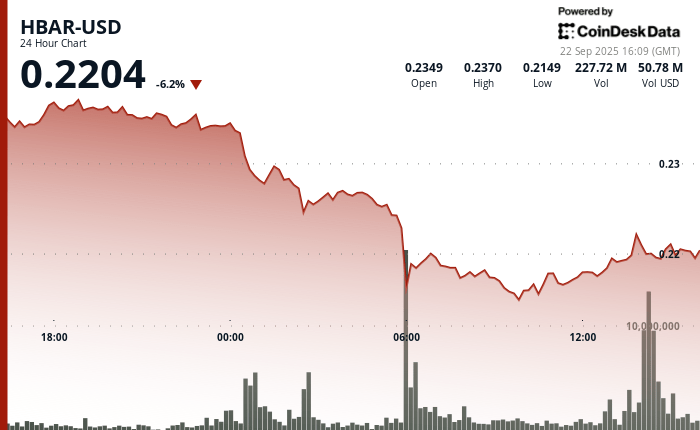

Hbar experienced a net slowdown on a 23 -hour negotiation window between September 21 and 22, while the token went from $ 0.24 to $ 0.22. The 6.29% drop was accompanied by a spectacular expansion of volatility, the commercial channels reaching 9.7% – well above the monthly averages. Market pressure has intensified as institutional sellers lowered prices, establishing resistance from companies around the area from $ 0.235 to $ 0.24 and triggering a wave of liquidation.

The most pronounced sales pressure arrived at midnight on September 22, when volumes increased to 137.11 million, almost triple the daily basic line. This peak marked the peak of the sale while the feeling of the market was running through cryptographic assets, amplifying the decline of Hbar. At the August, the token oscillated around $ 0.22, signaling the capitulation of the potential among short -term holders.

However, the session ended with a notable rebound. During the last hour of negotiation, the Bulls resumed the momentum, from Hbar from $ 0.2197 to $ 0.2222. An escape above the $ 0.22 threshold was fed by an exceptional volume of 6.21 million in a few minutes, causing a short-term rally to session peaks close to $ 0.2225. The recovery highlighted the dynamics of the liquidity token of the token, although the volumes collapsed at zero in the last three minutes, suggesting a temporary balance.

Hbar’s volatile session highlights the increased sensitivity of the cryptography market to institutional flows and inversions focused on feeling. The combination of clear drops, disproportionate volume tips and a rebound at an advanced stage illustrates the rapid liquidity changes which define the markets of digital assets – recommend the speed with which the lower pressure can give way to opportunistic purchases.

Key technical indicators

- The price increases to $ 0.24 to $ 0.22 over 11 p.m. from September 21 3 p.m. to September 22 2 p.m.

- The volume explodes at 137.11 million to September 22, 00: 00, which triples daily average daily reference.

- Bears establish strong resistance at $ 0.24 where the price is reversed strongly on heavy sales.

- The bulls go up 1% recovery in the last 60 minutes of September 22 13:09 at 2:08 p.m.

- A rupture greater than $ 0.22 occurs at 13:54 on an exceptional increase of 6.21 million volumes.

- Zero trading volume in the last three minutes indicates a break from the temporary market after the volatile session.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.