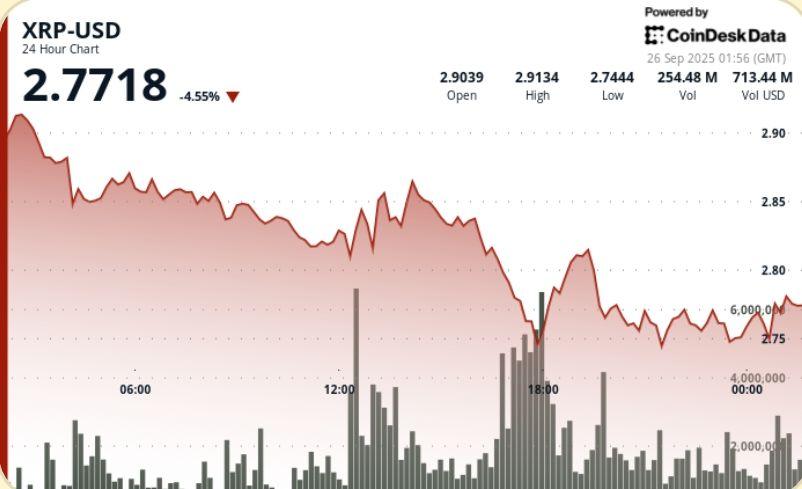

The XRP thrust over $ 2.90 collapsed under heavy sale on September 25, with a volume hammer price of $ 277 million at $ 2.75.

This decision erased more than $ 18 billion in market value in last week and has confirmed new resistance to $ 2.80, leaving traders rushing for a $ 2.70 test.

New context

• XRP slipped 5.83% compared to the session from September 25 to 26, from $ 2.92 to $ 2.75 on heavy institutional sale.

• A net rejection at $ 2.80 in 5:00 p.m. sparked a volume of 276.77 million – more than 2.5 times the average 24 hours a day.

• Despite the approval of the SEC first American ETF, optimism was offset by Powell’s warnings on assessments and the increase in treasury yields.

• During last week, XRP’s market value contracted by $ 18.94 billion, down 10.22%, exceeding the psychological threshold of $ 3.00.

Summary of price action

XRP exchanged between $ 2.92 and $ 2.74 – an intra -day range of 6.3% – before closing almost $ 2.75.

• The sellers dominated after a rejection of $ 2.80 on an extreme volume, creating a distribution area which capped further.

• Subsequent recovery attempts obtained a point of around $ 2.81 to $ 2.82, confirming new resistance clusters.

• The last hour saw a brief rebound of 1.09% from $ 2.75 to $ 2.78, driven by concentrated flows between 00: 50-00: 57 on volumes greater than 3 million per candle.

• Short -term support is now observed from $ 2.75 to $ 2.77, with a downward risk for $ 2.70 if it is raped.

Technical analysis

• range: $ 0.18 (6.3%) between $ 2.92 and $ 2.74 low.

• Resistance: $ 2.80 Initial rejection; $ 2.81 – $ 2.82 Clusters formed on failing reestes.

• Support: $ 2.75 area defended at the end of the session; $ 2.70 psychological level Watch Next.

• Volume: 276.77 m at 5:00 p.m. against 108.42 m on average daily.

• Model: distribution of high volume rejection signals. Short -term consolidation almost $ 2.77 suggests an indecision before the next move.

What traders look at

• that $ 2.75 holds via the session in Asia or breaks around $ 2.70.

• Optimism of ETFs against real money outings – the sales model of the sale remains at stake.

• Whales flow after 800 million dollars in transfers in last week; Position the risk if the sale of curriculum vitae.

• Macro overhangs: Powell’s fertilizer tone, Treasury yields, climbing, capsuoned cup expectations.