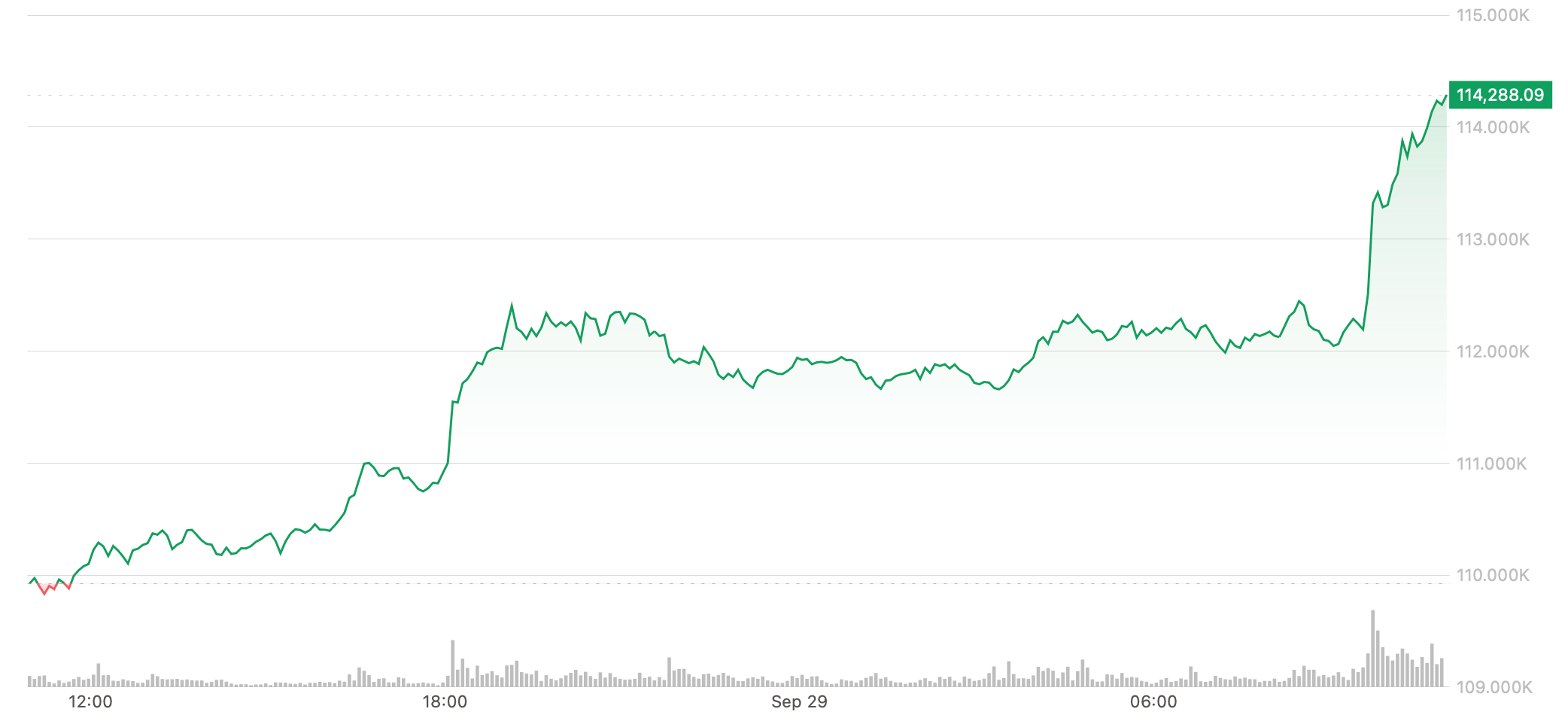

A net rally that started at the end of the weekend continued in us the Monday morning negotiation hours, with Last Friday, the overhaul of $ 114,000 after dropping $ 109,000.

This decision suggests that cryptographic traders respond to the same macroeconomic factors – namely interest rates lower than the West – which lead gold and numerous stock market indices to new records on almost daily. He also suggests a seasonal factor, investors accentuating the historic weakness from September to October – sometimes nicknamed “uptober” because of the trend of the price increase.

Bitcoin and other major cryptos – ETH, XRP and Sol among them – are all about 4% in advance in the last 24 hours. The gold is ahead of 1.2%, affecting another record greater than $ 3,850 per ounce and the NASDAQ is higher by 0.8%.

Among the actions related to the crypto, Coinbase (corner) and the stablecoin circle (CRCL) transmitter up 5.7% and 7.7%, respectively.

Particularly struck during the carnage last week, minors see a considerable rebound. Artificial intelligence and high -performance IT actions such as IREN (IREN) and the exploration of figure exploration (CIFR) are both up 4%. Mara Holdings (Mara) – With a greater emphasis on the extraction and stacking of pure bitcoin – is 8%ahead.

The small rebound is not surprising, said Paul Howard, principal director of the commercial company Winccent, although the macro environment is a little uncertain.

“We have seen institutional and retail support at $ 110,000 from those who missed BTC in $ 100,000,” he said in a ticket. “There are still lower risks until we saw a larger macro moving the coming month.”

The Friday job report could offer traders a clearer vision of the labor market, but an imminent government closure threatens to delay the release. If the closure takes place, the federal reserve may be forced to hold its next political meeting from October 28 to 29 without access to critical economic data.

October could bring relief for cryptographic markets

Joel Kruger, market strategist at Lmax Group, said seasonality “was about to turn strongly in favor of Bitcoin”, because generally weak September gives way to the strongest months of Bitcoin historically.

BTC posted an average yield of 22% in October since 2013, in November producing even stronger gains of 46% during the same period, he noted.

“In the context of a historic year for the crypto – marked by significant adoption and regulation progress – these seasonal tail winds could open the way to Bitcoin to challenge and even exceed the previous records before the end of the year,” said Kruger.