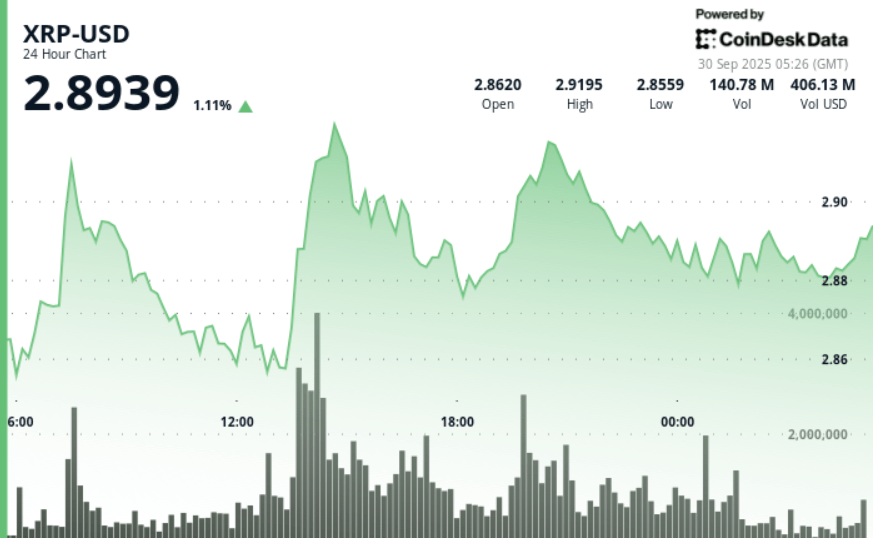

XRP won 2.1% during the 24 -hour negotiation session from September 28 at 9:00 p.m. to September 29 at 8:00 p.m., from $ 2.84 to $ 2.90 while moving within a range of $ 0.10 which represented 3.47% of the opening price.

New context

• Large institutional addresses holding between 10 and 100 million XRP tokens have accumulated more than 120 million parts in the last 72 hours.

• Seven ETF SPOT XRP applications remain in instance before the SECURITIES AND EXCHANGE US Commission. Graycale’s submission is scheduled for October 18, with others than the queue until November 14, creating a far window of regulatory catalysts which could reshape the short -term flows.

• The feeling of the market was supported by the anticipation of an increased exposure of the business portfolio. Analysts supervise FNB approvals as a structural engine that could accelerate the adoption of XRP in institutional allocation strategies.

Summary of price action

• XRP exchanged in a corridor of $ 0.10, fluctuating between a minimum of $ 2.84 and a summit of $ 2.93, reflecting a volatility of 3.5% during the period. The price ended nearly $ 2.93 when the sales pressure intensified, especially during the 2:00 p.m. session of September 29.

• The largest increase movements arrived at 02:00 and 7:00 GMT on September 29, where the volume increased to more than 97 million units. These overvoltages have considerably exceeded the daily average of 57.4 million, confirming institutional participation during the rally phases.

• The last hour of negotiation extended the advance, because the price went from $ 2.88 to $ 2.90 for a late gain of 0.7%. The violation of the $ 2.90 psychological barrier was confirmed by a burst of 4.8 million unit volumes, passing the session to its peaks before settling around $ 2,9045.

Technical analysis

• The resistance is grouped between $ 2.92 and $ 2.93, where the price was blocked several times on a higher volume. This area marks the next obstacle for the prosecution, with a confirmation of rupture probably requiring a fence greater than $ 2.93 on increasing participation.

• The support consolidated between $ 2.85 and $ 2.86, where buyers systematically defended the offers during the retirements. Multiple success of this band throughout the session highlight its importance as an accumulation zone.

• The psychological level of $ 2.90 went to a short -term pivot. Price recovered it at the end of the session, and the merchants will monitor if it can contain a support before the weekend.

• Volatility on the 24 -hour window reached 3.47%, in accordance with high institutional repositioning around key regulatory catalysts.

What traders look at

• The question of whether XRP can maintain ends above $ 2.90 and overthrow this in support, which would validate attempts to continue around $ 3.00 and beyond.

• The October-November ETF exam window, with the date of October 18 of Graycale considered as the first major structural catalyst for institutional entries.

• activity of the whale portfolio, with 120 million tokens accumulated over three days suggesting more upward if this rate continues.

• Larger macro-conditions, with the volatility of the Treasury yields and the Fed’s political signals, influencing the appetite for risks between actions and digital assets.