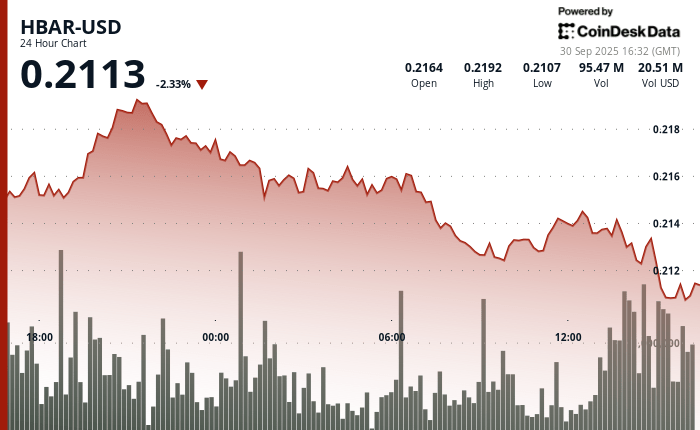

The Hedera Hashgraph Hbar token slipped almost 3% within 24 hours until September 30, from $ 0.22 to $ 0.21 while institutional investors have written an exhibition to cryptocurrencies focused on the company. The decline occurred after Hbar encountered resistance at $ 0.22 during the evening negotiations on September 29, volumes climbing above 34 million tokens while business holders began to make profits.

The market participants said that support around the $ 0.21 threshold initially held throughout the morning of September 30, but that heavy sales in the afternoon increased volumes, culminating at almost 55 million tokens in the last hour of negotiation. Analysts suggested that this decision reflected growing prudence among business treasury bills following the development of regulatory managers for the adoption of business blockchain.

At the end of the afternoon on September 30, Hbar briefly recovered before slipping into intrajournable stockings again around $ 0.21. A high commercial activity during the last hour – exceeding 5.9 million tokens in a single interval – highlighted the intensity of institutional rebalancing. The token ended the session with modest stabilization close to $ 0.21, but market observers have warned that continuous volatility can persist while business strategies adapt to the change of regulatory opposite winds.

Market analysis

- The resistance established at $ 0.22 during September 29 in the evening with institutional profits over a volume above average.

- The support zone identified approximately $ 0.21 at $ 0.21 with several business purchase opportunities throughout morning sessions.

- The volume increases to 54.88 million tokens in the last hour indicating the accelerated institutional risk management protocols.

- Extraordinary negotiation activities reaching 5.90 million tokens during the interval of 3:10 p.m. and 4.51 million at 3:11 p.m.

- Break lower than the established support zone suggesting a continuous potential casualness of companies in the corporate blockchain sector.

- Price stabilization efforts close to $ 0.21 level per session end with supported institutional negotiation volumes.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.