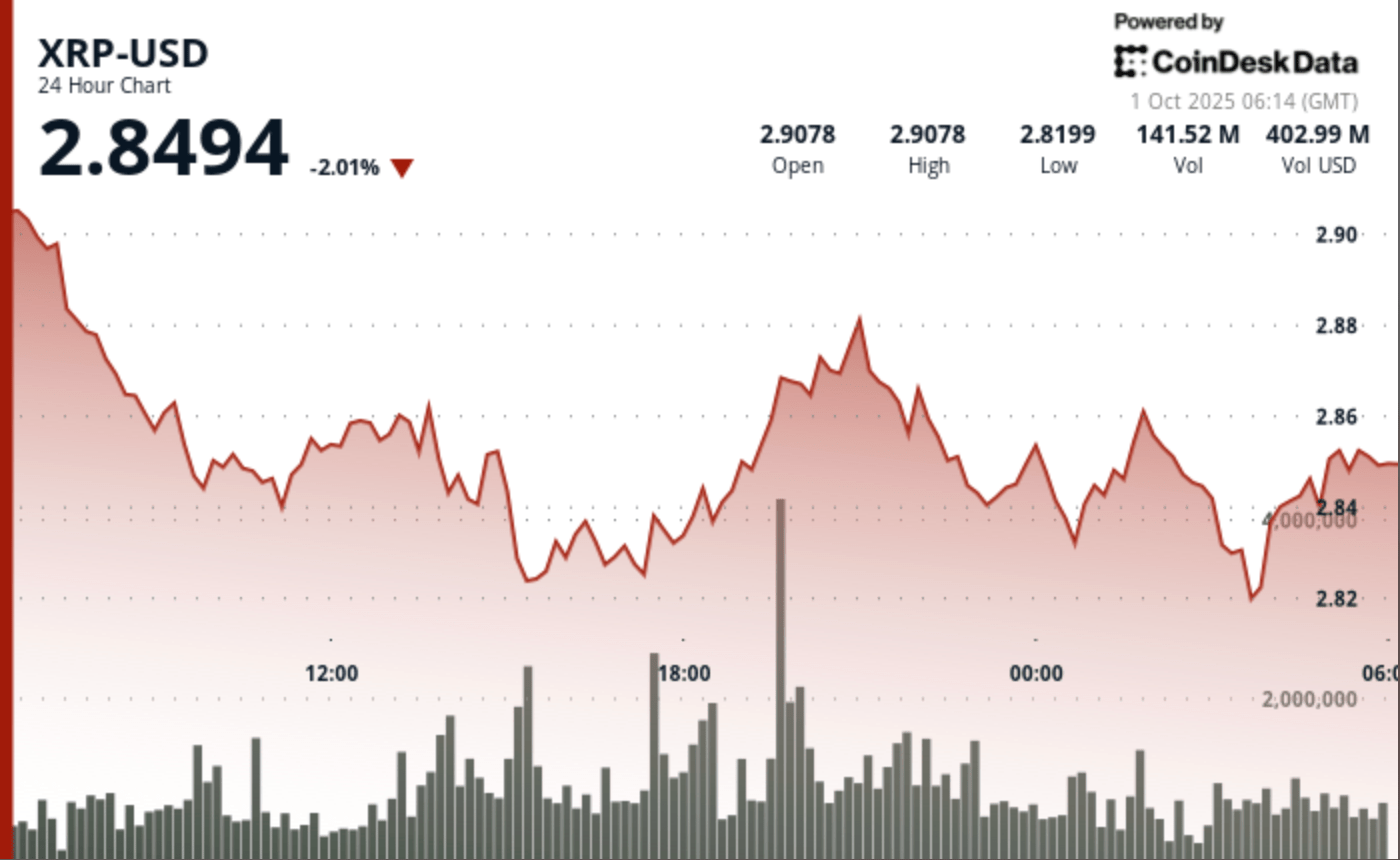

XRP exchanged inside a compressed corridor of $ 0.09 after an early push at $ 2.91 was filled with net benefits. Buyers defended the area from $ 2.82 to $ 2.84, leaving the token to be consolidated at $ 2.85 at the end as tapered volumes. Analysts reported lowering divergences while the reserves increased on Binance, which has been caution before the $ 3.00 test.

New context

- XRP experienced entries of more than $ 6 billion over two days, motivated by the adoption of the treasury and speculative positioning.

- The regulatory objective has weakened as the reports reported no business purchase order in Binance despite increasing reserves.

- Wall Street’s technical offices advise caution until an escape above the $ 3.00 threshold confirms the trend.

Summary of price action

The aggressive purchase pushed XRP at $ 2.91 at 06:00 out of 49.8 million volumes.

The price reduced for profit at $ 2.82 to $ 2.84, with a turnover higher than the average 24 hours out of 24 of 56.8 million.

Stabilization in a strip of $ 2.85 to $ 2.86, with a volume slim at 4.9 million.

The market capitalization has closed nearly $ 2.85, consolidating the gains but not withdrawing the session summits.

Technical analysis

- The resistance hardened at $ 2.91 on a heavy rejection volume.

- Validated support from $ 2.82 to $ 2.84 with several purchase tips.

- Breakout, passing by $ 2.85 to 01:43 on 1.5 million tokens reported an algo -oriented request.

- Consolidation at the end of the session shows a reduced sales pressure but a low conviction.

- Divergences forming on Momentum indicators have the risk of short -term increase.

What traders look at

- Can XRP recover $ 2.91 and close above $ 3.00 to return the resistance?

- Impact of the increase in the 19% reserve of binance and if the entries represent the liquidity of the sale.

- Regulatory examination around exchange behavior and reported the lack of business offers.

- The dominant tone of Fed on the rates as a rear wind for the Q4 Crypto flows.