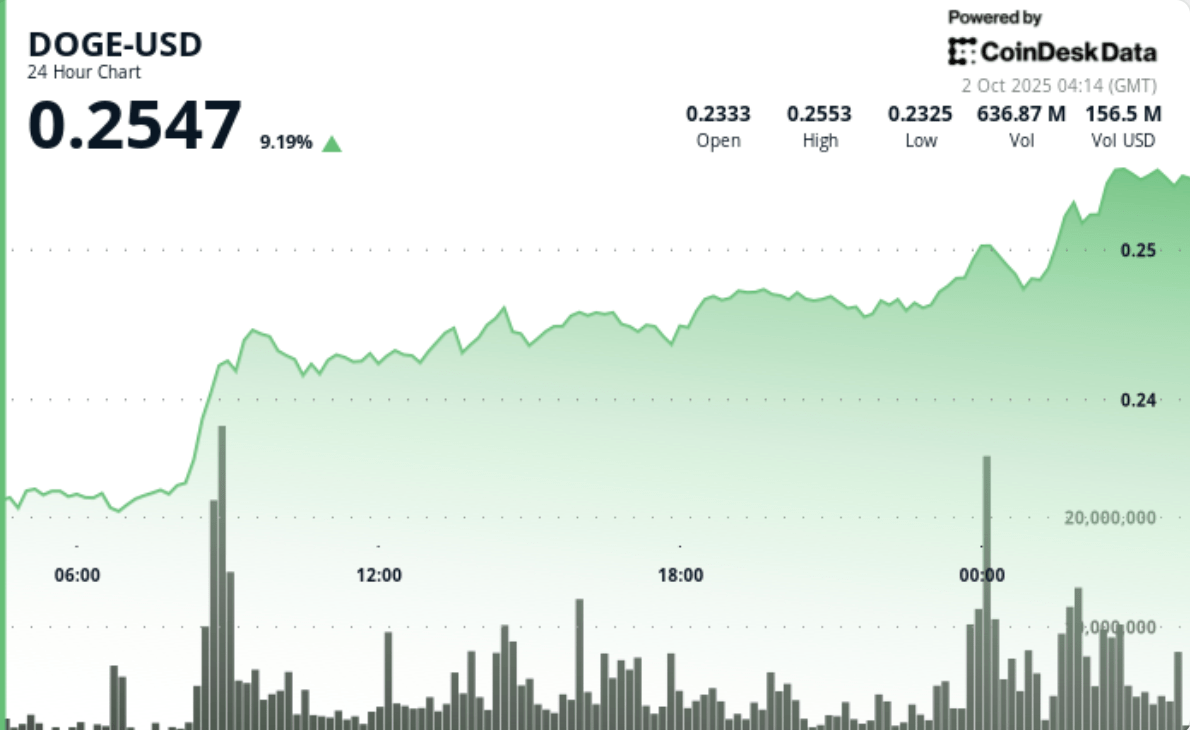

Dogecoin has torn almost 9% more, moving by resistance to more than a billion chips exchanged. Support reset to $ 0.242 after an early escape, while the end of the session flows pushed DOGE in the $ 0.254 area before consolidation.

Merchants highlighted the parallel rally of 6% of SHIB – supported by a turnover and trisk -token exchange scales of Billions of Billions at low levels of two years – as an additional proof of institutional accumulation between the same.

New context

DOGE increased by 8.8% by 24 hours from October 1 from 03:00 am to October 2 02:00 am, from $ 0.23 to $ 0.25. This decision was fueled by speculation around US ETF approvals and an aggressive institutional positioning.

SHIB also jumped 6.2% in the same window, the exchange reserves falling on multi -year stockings, highlighting a reduction in the available offer as memests have acquired a wider interest.

Summary of price action

- DOGE exchanged a corridor of $ 0.02, marking the volatility of 9.3%.

- The escape at 8:00 am spent the price from $ 0.234 to $ 0.242 on tokens of 1.03 billion tickets – 4x the average.

- The intrajournalier seals extended to $ 0.249 and $ 0.253 before the sellers capped at $ 0.254.

- The last hour saw DOGE climb from $ 0.248 to $ 0.254 on consecutive overvoltages of 40M and more, adjusting almost $ 0.252.

Technical analysis

The support increased to $ 0.242 after the break, with a hardened resistance at $ 0.254 to $ 0.255. The session carved an ascending triangle, validated by higher stockings and a sustained turnover.

The technical offices noted golden cross signals through the majors, strengthening the bullish momentum. Analysts reported a decisive break greater than $ 0.255 as opening a path to $ 0.32 – with flows controlled by ETF providing the catalyst.

Which traders are looking at?

- That DOGE can return $ 0.25 in the support of the company and push towards $ 0.32.

- If ETF speculation continues to underlie Doge and Shib within October.

- SPH of the SHIB exchange offer – two years old – like a potential rear wind for the rotation of the same.

- The reaction of the CD20 index after the two DOGE (+ 9%) and SHIB (+ 6%) displayed disproportionate movements on a heavy turnover.