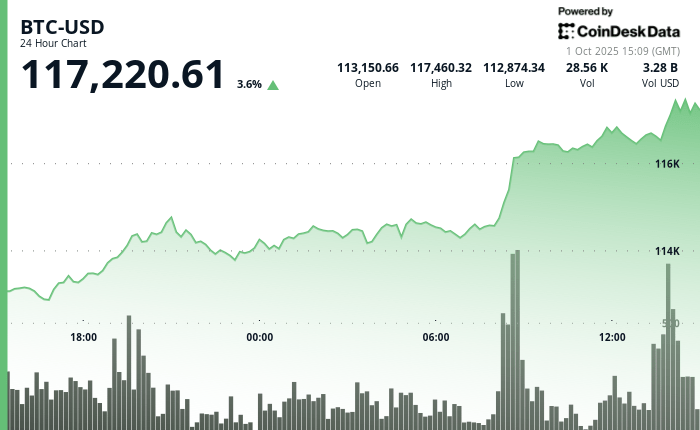

Cryptographic markets have gone positive in what has been in the past their strongest quarter of the year, with Bitcoin Increased by almost 4% in the last 24 hours to $ 117,400.

Already higher overnight, cryptography prices increased more at the start of the American session, as new economic data have suggested that the drop in September reserve rates in September will not be the last this year.

The private payroll has experienced its largest decrease in 2.5 years in September, private sector companies have lost 32,000 jobs according to a new report by the ADP payroll processing company. August, 54,000 gains were revised at a loss of 3,000 jobs.

Merchants would generally be much more focused on the monthly job report of the Labor Department due on Friday, but the press release will probably be delayed due to the closure of the current government.

Also on Wednesday, the PMI survey in September in September was online was online at 49.1, but the price index paid showed some news from welcome inflation, going to 61.9 from 63.7 in August and forecasts for 63.2.

In the shares, the Nasdaq and the S&P 500 were slightly down. Gold, which reached a new summit of $ 3,921 earlier Wednesday, returned to $ 3,888.

A look at altcoins show gains at all levels, with ether Sola’s Sol And In addition from 5% to 7% in the last 24 hours, exceeding Bitcoin’s advance.

In the midst of uncertainty about the versions of upcoming data to guide monetary decision -makers on the economy, market players nevertheless expect universally expecting a reduction in reference interest rates at the next October meeting. The CME Fedwatch tool has a probability of 99% of a reduction of 25 basic points, compared to 92% a week ago.

October starts hard

September has generally been a perfidious month for the crypto, but shortly in the feeling of poor investors recently, Bitcoin had one of its best September for many years, winning around 6% for the month.

In the past two days of September, the Bitcoin ETFs have collected $ 950 million in entries, reversing $ 900 million in the previous week.

“The next quarter should see the start of the Haussier market of cryptography,” said Noelle Acheson, author of the crypto is Macro Now Newsletter. His prospects are motivated by the incoming macro-qua ventilators in the form of a relaxation of interest rates and other potential policy supports such as the control of the yield curve being in the cards to maintain the stable markets if the global economy becomes sour.

This environment should also be positive for Altcoins, she said, with new ETF spots probably coming to the market, attracting the attention of investors to the sector. “The upcoming quarter should kick off the” Alt season “, while attention is starting to turn away from” majors “(BTC and ETH) and to smaller and more volatile tokens”.