The eccentric data shows that the American Bitcoin funds negotiated on the stock market (ETF) have recorded their largest entry since September 10, with $ 675.8 million. Ishares Bitcoin Trust of Blackrock (Ibit) captured the majority, taking 405.5 million dollars, it is the largest entry since August 14 and pushing its total net entries to 61.376 billion dollars. The overvoltage coincided with the fact that Bitcoin climbs more than $ 119,000, a gain of 4% during the day.

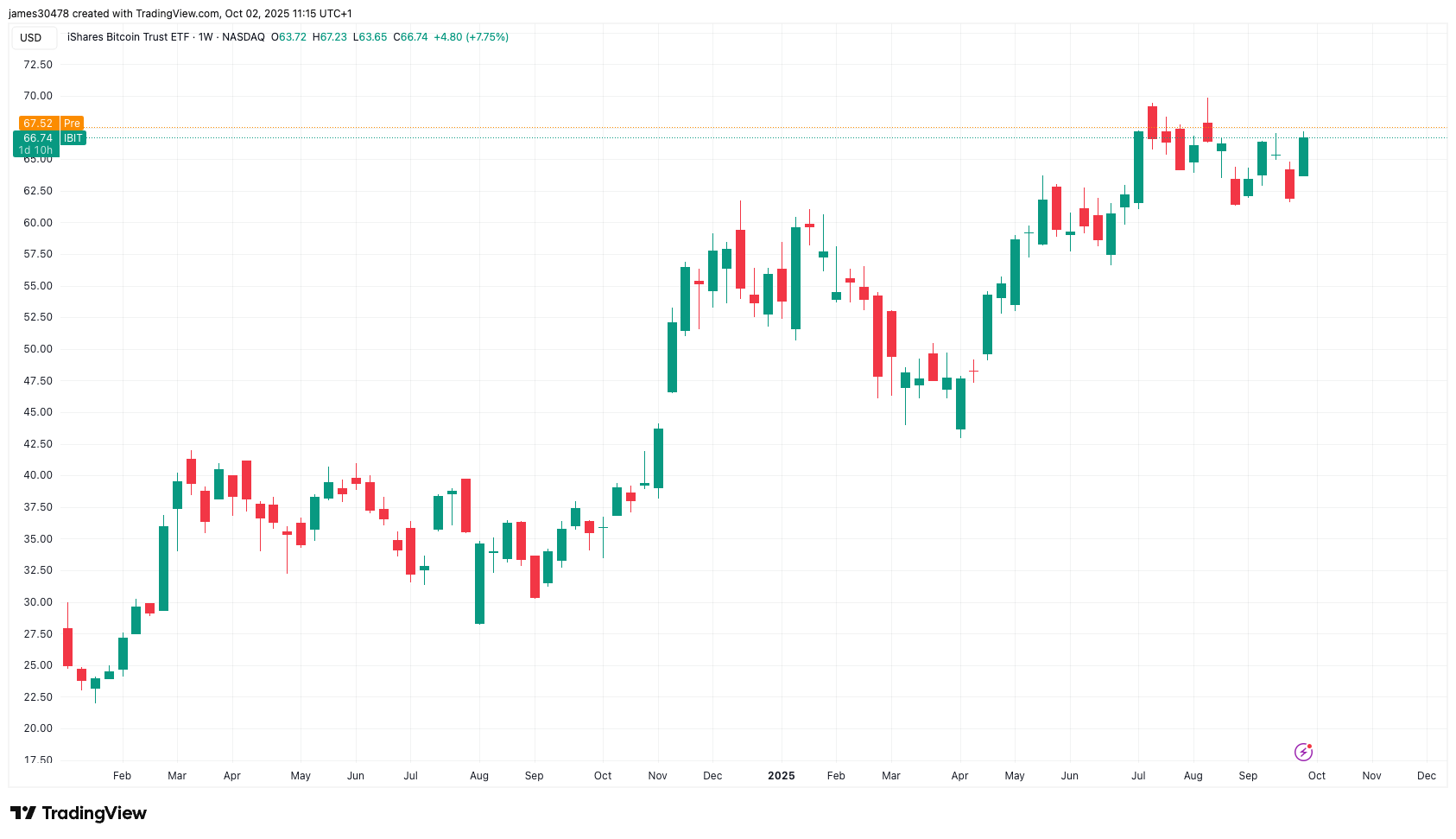

According to Bloomberg’s senior ETF Eric Balchunas, Ibit Ibit entered the 20 best ETF for the first time, reaching $ 90.7 billion. Since the launch in January 2024, Ibit has increased by 175%.

Balchunas noted that Ibit entering the 10 best ETFs by assets may not be distant, fixing in December 2026 as a potential target. “Someone asked me how long until the top 10. He is $ 50 billion. If the last 12 months are repeated, it may not take time. He has taken $ 40 billion in the past year and has won 85%.

On Wednesday, the 4% Bitcoin increase did not succeed in daily performance among the first 10 in 2025. Velo data showed that Wednesday was, on average in the past year, the most optimistic day in Bitcoin, while Thursday was the most lowered.