Bitcoin has increased by 10% this week while several groups of portfolio carriers go from distribution to accumulation for the first time since August. The largest cryptocurrency exceeded $ 121,000 on Thursday, the highest since it reached a record on August 14, according to Coindesk data.

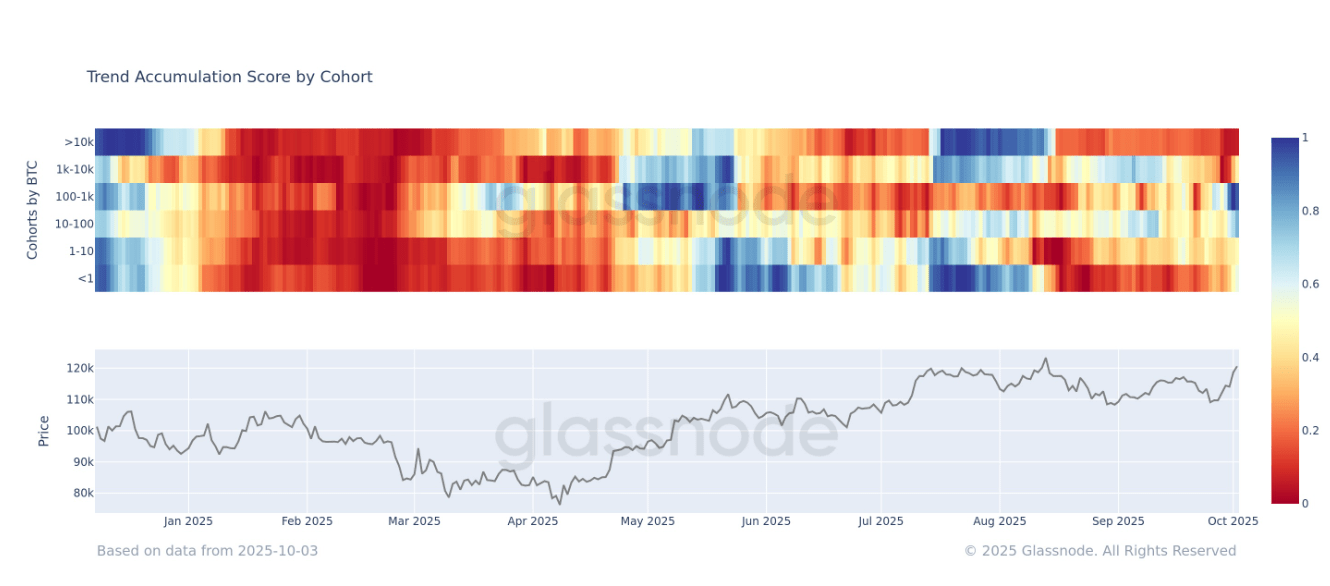

The accumulation trend score, which measures the relative resistance of accumulation or distribution over a period of 15 days, increased to 0.62, according to Glassnod data.

This value is greater than the neutral threshold of 0.5, indicating that, in total, market players seek to buy rather than sell. A reading closer to 1 indicates a stronger accumulation, while a reading closer to 0 suggests a distribution.

Decomposed by cohort, portfolios holding between 100 and 1,000 BTCs have strongly plunged into accumulation after distributing parts last week. Those who hold between 10 and 100 BTCs also start to accumulate again. The participants in the retail trade, who hold less than 10 BTC, have considerably slowed down their sale and begin to show signs of buying activity.

On the other hand, large whales with sales greater than 10,000 BTC remains strongly in the distribution, extending a trend that has persisted since August.

In addition to these changes in the behavior of the portfolio, a notable bullish trading model appeared in the American markets. From Monday to Thursday, Bitcoin has always won during American negotiation hours, increasing by around 8% during these single sessions, according to VELO data.